[ad_1]

Introduction to Stripe Reconciliation

Each digital buy is a posh interaction of entities—Prospects, Retailers, Acquirers, and Issuing Banks—that orchestrate the stream of funds. A Fee Service Supplier (PSP) acts as an middleman between retailers and the monetary establishments concerned in processing on-line transactions. Stripe is a PSP that gives a set of companies to streamline cost processing and improve the net purchasing expertise.

Stripe not solely facilitates seamless cost processing but additionally simplifies the reconciliation course of by offering detailed transaction information and integrations with accounting software program, guaranteeing accuracy and effectivity in monetary administration. On this overview, we will look into the core rules of Stripe Reconciliation, focus on its significance and perceive its complexities to equip companies with the instruments they want for enhanced monetary transparency and operational effectivity.

What’s Stripe Reconciliation?

Stripe Reconciliation refers to using Stripe for the systematic technique of matching and verifying transactions processed by means of the Stripe cost gateway with corresponding entries in your accounting information. It ensuresthat the cash flowing by means of the Stripe account matches what your small business expects, leaving no room for discrepancies or errors.

Stripe can be utilized to automate the comparability of inside information like invoices with exterior information reminiscent of settlement recordsdata and financial institution statements, lowering guide effort and errors. Day by day money monitoring offers real-time insights into money positions, very important for efficient monetary administration. Swift identification of discrepancies prevents income leaks, whereas transaction life cycle visibility ensures thorough monitoring. Sturdy monetary controls are applied by means of automated reconciliation and detailed transaction monitoring, safeguarding in opposition to errors and fraud. Stripe’s scalable options accommodate rising transaction volumes and complexities, making it invaluable for companies with dynamic monetary wants.

How are transactions processed by means of Stripe?

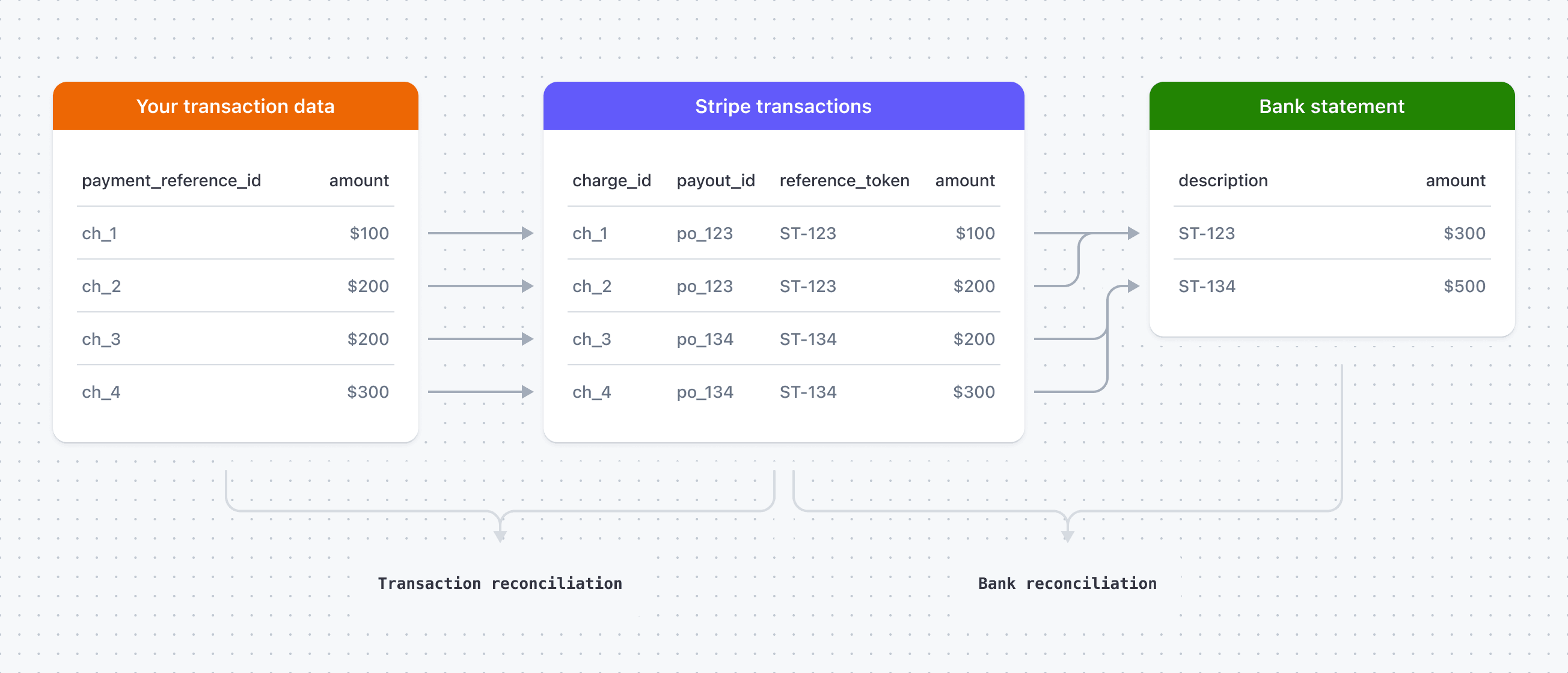

Stripe harnesses three major datasets in its reconciliation efforts:

- The corporate’s transaction information: This encompasses inside information of funds, reminiscent of gross sales information or invoices, reflecting the gross quantity for every transaction saved inside your system. Stripe makes use of this information to estimate anticipated gross quantities for transactions and to create cost expectations.

- Stripe transactions: These are confirmations of cash motion generated by Stripe, encompassing prices, refunds, or payouts processed by means of the platform. This information is mechanically fetched into the reconciliation workspace each 12 hours, offering real-time insights into transactional exercise.

- Financial institution statements: These statements validate the cash motion claimed by Stripe in your checking account. Stripe instantly fetches this information by means of Monetary Connections every day, guaranteeing alignment between Stripe’s information and precise financial institution deposits.

Stripe reconciliation facilitates three forms of reconciliations:

- Financial institution reconciliation: Aligns payouts made by Stripe with money deposits in your checking account, requiring entry to your financial institution assertion by means of Monetary Connections.

- Transaction reconciliation: Permits reconciliation of particular person Stripe transactions with inside information, guaranteeing consistency and figuring out any discrepancies between the 2 datasets.

- Mixture of transaction and financial institution reconciliation: Tracks the entire lifecycle of transactions from initiation to financial institution deposit, offering a complete overview of economic operations.

By establishing this three-way reconciliation course of, companies can meticulously observe data throughout programs, validate information accuracy, and guarantee monetary integrity earlier than updating their books, empowering them with enhanced transparency and effectivity in managing on-line transactions.

Varieties of transactions supported by Stripe

From conventional card funds to rising cost strategies, Stripe’s versatility permits companies to streamline income streams, automate monetary processes, and embrace unified commerce fashions.

- Card Funds: Stripe helps a variety of card funds, together with credit score and debit playing cards, permitting companies to just accept funds from prospects worldwide securely.

- ACH Debits: Splendid for recurring funds or subscription-based fashions, ACH debits allow companies to withdraw funds instantly from prospects’ financial institution accounts.

- Financial institution Transfers: Stripe facilitates Euro financial institution transfers, offering prospects with the pliability to pay instantly from their financial institution accounts, enhancing comfort and lowering transaction prices.

- Different Fee Strategies: Stripe integrates with a plethora of different cost strategies reminiscent of Alipay, Apple Pay, and Blik, catering to the preferences of numerous buyer demographics and enhancing checkout experiences.

- Clearpay and Affirm: With Clearpay for purchase now pay later choices and Affirm for versatile financing options, Stripe empowers companies to supply versatile cost phrases, driving conversion charges and buyer satisfaction.

- Dispute Dealing with: Stripe offers sturdy dispute dealing with mechanisms, enabling companies to effectively handle and resolve cost disputes, safeguarding income and sustaining buyer belief.

- Income and Finance Automation: Stripe’s suite of income and finance automation instruments streamlines processes reminiscent of invoicing, billing, and income recognition, empowering companies to optimize money stream and monetary operations.

- Unified Commerce: Whether or not for skilled companies, SaaS, or subscription-based companies, Stripe presents unified commerce options that seamlessly combine with current workflows, enabling companies to handle all elements of their operations from a single platform.

Arrange Stripe Reconciliation?

Establishing of the Stripe Reconciliation course of usually includes the next steps:

- Add Transaction Information:

- Go to the Stripe Dashboard’s reconciliation overview web page.

- Click on on “Import information”.

- Choose your file

- Click on “Import CSV”.

- Observe Progress:

- Monitor the progress of the import by clicking “View information administration”.

- Perceive Reconciliation Information Schema:

- Be certain that the transaction information meets Stripe’s required fields to transform it to the canonical reconciliation schema.

- Automated Reconciliation:

- As soon as information is imported, reconciliation begins mechanically.

- Every transaction receives a reconciliation standing based mostly on its alignment with Stripe information and financial institution statements.

- Configure Thresholds:

- Configure reconciliation thresholds for settlement and transaction reconciliation in line with your particular necessities.

- Monitor Reconciliation Statuses:

- Recurrently verify reconciliation statuses for each settlement and transaction reconciliation.

- Perceive the implications of various reconciliation statuses, reminiscent of “Fully matched”, “Partially matched”, “Unmatched”, “Settled”, “In course of”, “Open”, and “International”.

- View Analytics:

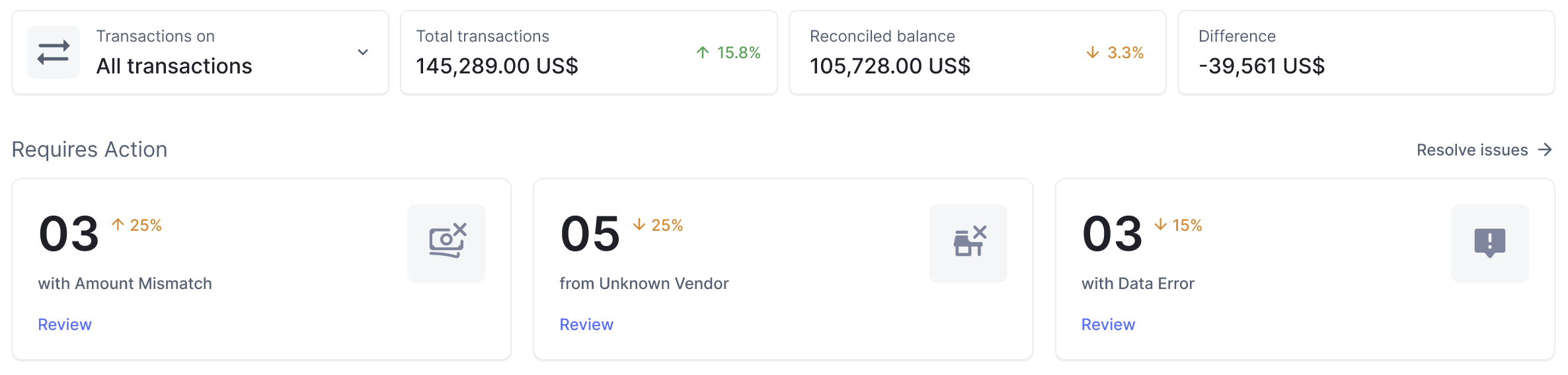

- Make the most of the reconciliation analytics web page to achieve high-level insights into your small business’s cash motion.

- Analyze charts for reconciliation standing and ageing summaries to trace fund disbursement and adherence to service stage agreements (SLAs).

- Generate Stories:

- Entry normal stories from the Stripe Dashboard, together with reconciliation end result stories, settlement stage stories, and transaction-level search stories.

- Customise report sorts and filters to acquire particular insights into transaction reconciliation, pay-in reconciliation, and settlement reconciliation.

- Obtain Stories:

- Generate and obtain stories to evaluate transaction reconciliation statuses, pay-in reconciliation outcomes, and settlement particulars.

- Use these stories to validate monetary transactions, determine discrepancies, and optimize monetary processes.

Greatest Practices for Stripe Reconciliation

To harness the complete potential of Stripe Reconciliation, companies ought to adhere to a set of greatest practices aimed toward optimizing effectivity and mitigating dangers.

- Constant Reconciliation: Routine cost reconciliation ensures an everyday cadence. This proactive method empowers companies to swiftly determine and rectify errors or inconsistencies, sustaining the integrity of economic information.

- Division of duties: Errors and fraud may be mitigated by dividing obligations. Transaction recording and account reconciliation may be segregatedd to ascertain a sturdy system of checks and balances inside the organizational framework.

- Standardize Operations: The design of standardized procedures for reconciliation fosters uniformity and precision. It helps to doc these protocols and guarantee adherence throughout the organizational spectrum.

- Thorough Documentation: Full information of the reconciliation course of present complete insights and facilitate audits. These detailed accounts function invaluable references, providing historic context and aiding in error decision.

- Swift Response to Discrepancies: Discrepancies have to be promptly addressed, errors rectified and funds recuperated when essential. Speedy intervention is vital to upholding monetary accuracy and trustworthiness.

- Worker Empowerment: All stakeholders have to be educated to make use of the system. Familiarizing them with accounting rules, laws, and the operation of Stripe, ensures proficiency and efficacy of their roles.

- Implement Oversight Mechanisms: A sturdy evaluate and approval course of is important for reconciliation stories, instilling an extra layer of scrutiny and guaranteeing thoroughness.

- Fortify Safety Measures: Monetary information and programs have to be secured by proscribing entry to approved personnel and instituting stringent safety protocols. Delicate data have to be shielded from unauthorized entry.

- Steady analysis and testing: Steady analysis and refinement of the reconciliation course of, benchmarking in opposition to trade requirements and looking for avenues for enchancment fosters continuous progress and operational excellence.

- Open Channels of Communication: Clear communication channels have to be maintained with pertinent stakeholders, together with banks and distributors. This facilitates seamless subject decision and ensures entry to important data for knowledgeable decision-making.

Automate Reconciliation with Stripe and Nanonets

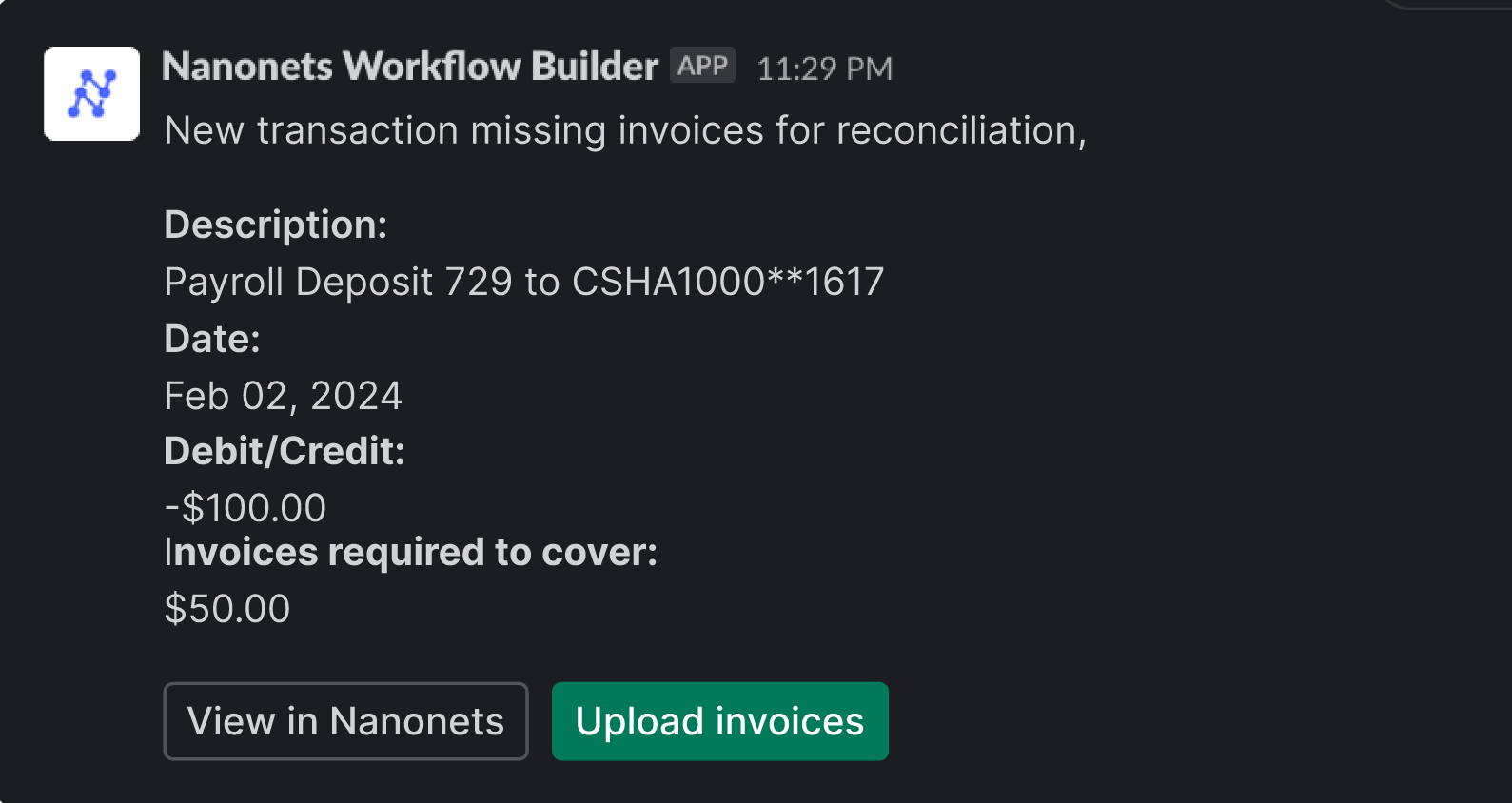

Nanonets (as talked about above) presents AI-powered options for automating account reconciliation processes, enabling companies to streamline operations, scale back guide effort, and enhance accuracy. Moreover, Nanonets integrates seamlessly with Stripe, offering companies with a complete answer for monetary administration and account reconciliation.

Key advantages of Nanonets for automated account reconciliation:

- Automated Information Extraction: Nanonets leverages superior Optical Character Recognition (OCR) expertise to mechanically extract related information from invoices, financial institution statements, receipts, and different monetary paperwork. This eliminates the necessity for guide information entry and reduces the chance of errors, guaranteeing correct reconciliation.

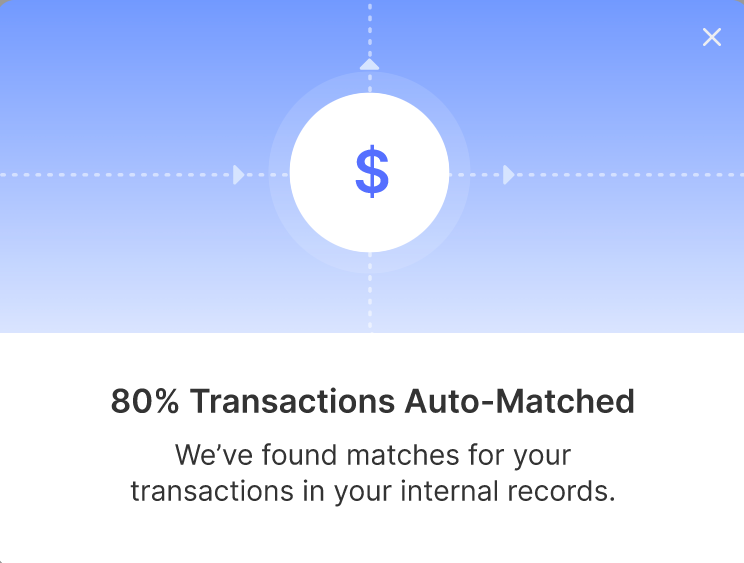

- Clever Information Matching: With Nanonets’ AI algorithms, you’ll be able to match transactions throughout completely different programs and determine discrepancies with precision. The system intelligently analyses transaction information, identifies patterns, and reconciles accounts effectively, saving useful time and sources.

- Seamless Integration: Nanonets simply integrates with Stripe and different accounting software program, permitting for seamless information alternate and synchronisation. This integration streamlines the reconciliation course of, enhances information accuracy, and ensures consistency throughout monetary programs.

- Customizable Workflows: Nanonets presents customizable workflows that may be tailor-made to your particular reconciliation necessities. Whether or not it is advisable to reconcile giant volumes of transactions or handle complicated accounts, Nanonets’ versatile workflow automation capabilities can adapt to your distinctive enterprise wants.

- Actual-Time Reporting: Nanonets offers real-time visibility into the reconciliation course of, permitting you to watch progress, observe discrepancies, and generate complete stories. This real-time perception permits proactive decision-making, improves monetary transparency, and enhances compliance.

With Nanonets, companies can obtain better effectivity, accuracy, and compliance of their reconciliation processes.

Conclusion

Leveraging Stripe reconciliation empowers companies to keep up a agency grip on their monetary operations. With this device, companies can observe day by day money flows, swiftly determine and rectify discrepancies to stop income leakages, and acquire complete visibility into your complete lifecycle of every transaction. Stripe reconciliation facilitates the implementation of strong monetary controls, safeguarding companies in opposition to errors and fraud. Its scalability ensures that companies can set up processes that develop with their increasing operations, providing flexibility and adaptableness to fulfill evolving wants. Stripe reconciliation can present companies with the instruments they should optimize effectivity, accuracy, and resilience of their monetary operations.

[ad_2]

Supply hyperlink