[ad_1]

Introduction

Should you’ve ever questioned how companies preserve observe of their spending or make sure that each greenback is accounted for, you’re in the suitable place. Expense reconciliation is the method by way of which companies observe expenditures, determine anomalies, adhere to regulatory necessities, and keep monetary accuracy and integrity.

By this information, we’ll outline what expense reconciliation is, discover its significance to firms, the formal strategies of going about it, in addition to the challenges and greatest practices concerned. We may also uncover how cutting-edge automation options comparable to Nanonets can revolutionise the expense reconciliation course of, unlocking newfound efficiencies and insights for companies of all sizes.

What’s Expense Reconciliation?

Expense reconciliation is a course of inside finance and accounting that ensures that an organization’s monetary information precisely mirror its spending actions. At its core, it includes evaluating monetary knowledge from numerous sources inside a enterprise to determine any discrepancies or errors and convey them into alignment.

In easier phrases, expense reconciliation is a means for companies to double-check their monetary information to ensure every little thing provides up accurately. Identical to balancing a chequebook or tallying up receipts to match your month-to-month financial institution assertion, expense reconciliation helps make sure that all of a enterprise’ bills are correctly accounted for and recorded.

This course of usually includes reviewing transactions, invoices, receipts, and different monetary paperwork to confirm that they match up with the corporate’s information and funds. By evaluating these information, companies can determine any discrepancies, comparable to lacking or duplicate transactions, incorrect or false quantities, or any unauthorised bills and transactions. This course of is crucial for sustaining monetary accuracy, compliance with laws, and stopping fraud or errors. It offers organisations with a transparent and correct image of their spending habits and total monetary state of affairs, permitting them to handle budgets, make knowledgeable selections, and successfully handle the enterprise.

Within the subsequent sections, we’ll discover completely different strategies of expense reconciliation, examples of the way it’s utilized in apply, and why it is so necessary for companies of all sizes.

The Significance of Expense Reconciliation

Expense reconciliation holds vital significance within the realm of finance and accounting for a number of causes:

- Monetary Accuracy: One of many major causes for expense reconciliation is to make sure the accuracy of monetary information. By evaluating and reconciling bills towards numerous monetary paperwork, companies can detect and proper any discrepancies or errors, making certain that their monetary statements mirror the true state of their funds.

- Compliance and Regulation: Expense reconciliation is essential for compliance with monetary laws and requirements. Many industries are topic to regulatory necessities relating to monetary reporting and transparency. By reconciling bills, companies can make sure that they adjust to these laws and keep away from potential penalties or authorized points.

- Fraud Prevention: Expense reconciliation performs a crucial function in fraud prevention. By totally reviewing monetary transactions and figuring out any irregularities or unauthorised bills, companies can detect and stop fraudulent actions. This helps safeguard the corporate’s belongings and popularity.

- Finances Administration: Expense reconciliation offers companies with beneficial insights into their spending patterns and helps them handle their budgets extra successfully. By monitoring bills and figuring out areas of overspending or inefficiency, companies could make knowledgeable selections to optimise their funds allocation and enhance monetary efficiency.

- Determination-Making: Correct monetary knowledge is crucial for making knowledgeable enterprise selections. Expense reconciliation ensures that companies have dependable and up-to-date details about their bills, enabling them to make strategic selections that drive development and profitability.

General, expense reconciliation is crucial to making sure monetary accuracy, regulatory compliance, fraud prevention, environment friendly funds administration, and knowledgeable decision-making. By prioritising expense reconciliation, companies can keep monetary integrity and obtain their long-term monetary targets.

Expense Reconciliation: A number of Strategies and Fashions

Expense reconciliation may be carried out utilizing numerous strategies, every tailor-made to the precise wants and necessities of a enterprise. Listed below are a few of the widespread strategies for expense reconciliation:

Guide Reconciliation

In guide expense reconciliation, monetary professionals evaluate and examine expense information, comparable to receipts, invoices, and financial institution statements, manually. This methodology is painstaking and includes matching every expense entry with the corresponding documentation—payments, invoices, buy orders, cheques, financial institution statements and the likes—to determine discrepancies and errors. Whereas guide reconciliation may be time-consuming, labour-intensive, and error-prone, it gives a excessive stage of management and subjective human oversight into the method.

Spreadsheet Reconciliation

Spreadsheet software program like Microsoft Excel is usually used for expense reconciliation. Monetary professionals enter expense knowledge into spreadsheets and use formulation and features to check and reconcile bills. Spreadsheet reconciliation gives flexibility customization choices, however will also be liable to errors. It additionally lacks scalability, because the professionals working with the related Excel sheets possess a type of tribal data that isn’t simply transferable to any new stakeholder who would possibly have to develop into concerned in expense reconciliation.

Automated Reconciliation

With developments in expertise, many companies are turning to superior automated expense reconciliation softwares, comparable to Nanonets. Such instruments streamline the reconciliation course of by mechanically extracting and matching expense knowledge from completely different sources, comparable to financial institution statements, bank card transactions, and expense studies. Nanonets makes use of superior synthetic intelligence and machine studying algorithms to determine patterns and discrepancies, considerably decreasing the time, effort, and errors concerned in reconciling bills. Automated reconciliation gives elevated effectivity, accuracy, and scalability in comparison with guide strategies.

Built-in Reconciliation

Built-in reconciliation includes integrating expense reconciliation functionalities into present accounting or ERP (Enterprise Useful resource Planning) programs. By integrating reconciliation capabilities immediately into the accounting software program, companies can streamline the reconciliation course of and guarantee consistency and accuracy throughout monetary workflows. Built-in reconciliation options typically provide real-time knowledge synchronisation and seamless integration with different monetary processes, comparable to accounts payable and accounts receivable.

Outsourced Reconciliation

Some companies select to outsource their expense reconciliation duties to third-party service suppliers. Outsourced reconciliation companies usually contain sending expense knowledge to a specialised agency or accounting service, which handles the reconciliation course of on behalf of the enterprise. Whereas outsourcing can alleviate the burden of reconciliation for companies, it is important to decide on a good supplier and guarantee knowledge safety and confidentiality.

General, the tactic of expense reconciliation chosen by a enterprise will rely on components comparable to the scale of the organisation, the quantity of transactions, obtainable assets, and particular enterprise wants. Every methodology has its benefits and limitations, and companies ought to fastidiously consider their choices to find out essentially the most appropriate strategy for his or her necessities.

Examples of Expense Reconciliation

Expense reconciliation is a essential aspect of companies throughout numerous industries and sizes. It’s an integral a part of a enterprise’ operations, serving to them keep correct monetary information and making certain compliance with regulatory necessities. Listed below are some examples of expense reconciliation generally carried out by companies:

- Financial institution Reconciliation: Financial institution reconciliation includes evaluating the transactions recorded in an organization’s accounting information with these within the financial institution assertion to make sure consistency and accuracy. This course of helps determine discrepancies comparable to lacking transactions, financial institution errors, or unauthorised withdrawals. Financial institution reconciliation is often carried out month-to-month and includes matching deposits, withdrawals, and different financial institution transactions with corresponding entries within the firm’s accounting system.

- Credit score Card Reconciliation: Just like financial institution reconciliation, bank card reconciliation includes reconciling bank card transactions recorded within the firm’s accounting system with the bank card statements obtained from the bank card issuer. This course of ensures that every one bank card transactions are precisely recorded and accounted for within the firm’s monetary information. Bank card reconciliation helps determine discrepancies comparable to fraudulent transactions, duplicate prices, or unauthorised bills.

- Vendor Reconciliation: Vendor reconciliation includes reconciling accounts payable transactions with vendor statements to make sure that all invoices and funds are precisely recorded and accounted for. This course of helps determine discrepancies comparable to lacking invoices, overpayments, or pricing errors. Vendor reconciliation is crucial for sustaining good relationships with suppliers and avoiding cost disputes.

- Expense Report Reconciliation: Expense report reconciliation includes reconciling worker expense studies with receipts and different supporting documentation to make sure that all bills are professional and correctly documented. This course of helps determine discrepancies comparable to unauthorised bills, duplicate reimbursements, and non-compliant bills. Expense report reconciliation is essential for controlling prices and making certain compliance with firm insurance policies and laws.

- Stock Reconciliation: Stock reconciliation includes reconciling bodily stock counts with stock information to make sure accuracy and stop stock shrinkage or loss. This course of helps determine discrepancies comparable to stock discrepancies, stockouts, or surplus stock. Stock reconciliation is crucial for optimising stock administration, controlling prices, and bettering provide chain effectivity.

These are just some examples of expense reconciliation processes generally carried out by companies. Relying on the character of the enterprise and its operations, different kinds of expense reconciliation may additionally be essential to make sure monetary accuracy and integrity. By usually reconciling bills, companies can determine and resolve discrepancies promptly, keep correct monetary information, and make knowledgeable enterprise selections.

Step-by-Step Information to Performing Expense Reconciliation

Expense reconciliation is a scientific course of that includes evaluating and verifying monetary transactions to make sure accuracy and consistency. Here is a step-by-step information to performing expense reconciliation successfully:

- Collect Documentation: Acquire all related monetary paperwork, together with financial institution statements, bank card statements, vendor invoices, worker expense studies, and stock information. Guarantee that you’ve got entry to correct and up-to-date monetary knowledge to facilitate the reconciliation course of.

- Evaluation Transactions: Fastidiously evaluate every transaction recorded in your monetary information, together with deposits, withdrawals, purchases, funds, and bills. Confirm the accuracy of transaction particulars comparable to dates, quantities, descriptions, and account codes.

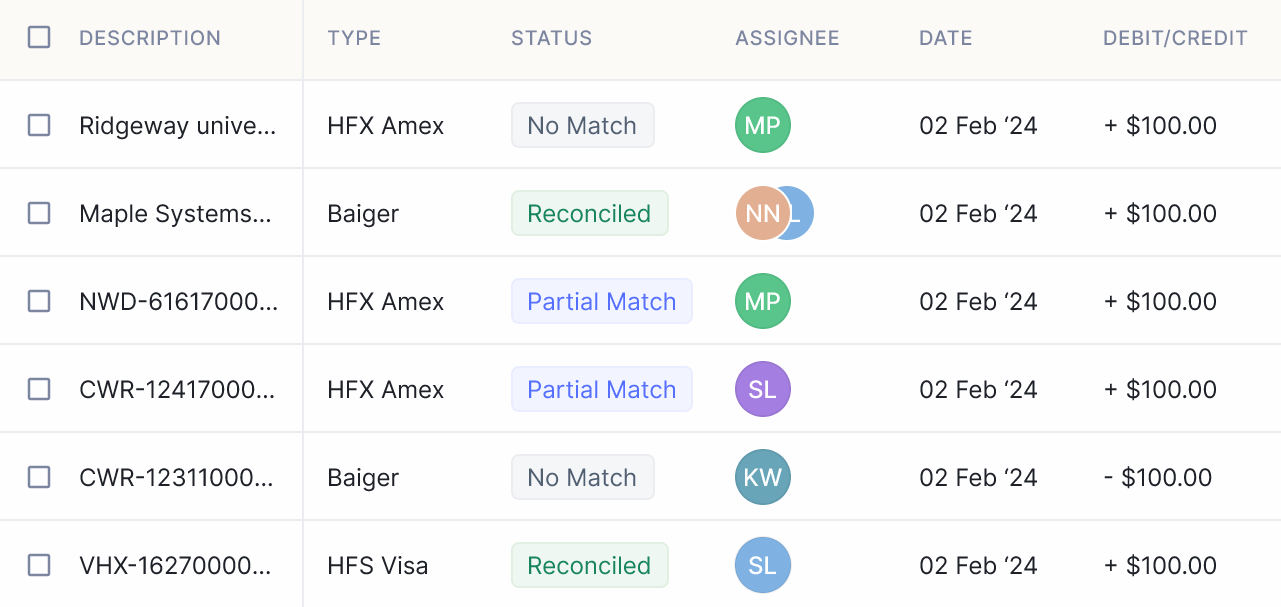

- Match Transactions: Examine the transactions recorded in your monetary information with these in exterior statements or paperwork, comparable to financial institution statements, bank card statements, vendor invoices, or worker expense studies. Make sure that every transaction is accurately matched and reconciled with its corresponding entry within the monetary information.

- Establish Discrepancies: Should you encounter any discrepancies or variations between the transactions recorded in your monetary information and exterior statements or paperwork, examine the basis reason for the discrepancies. Widespread discrepancies might embrace lacking transactions, duplicate entries, errors in quantities, or unauthorised bills.

- Resolve Discrepancies: Take acceptable actions to resolve any recognized discrepancies or errors. This may occasionally contain correcting knowledge entry errors, contacting distributors or monetary establishments to make clear transactions, or updating monetary information to mirror correct info.

- Doc Findings: Keep detailed documentation of the reconciliation course of, together with the steps taken, findings, and resolutions for any discrepancies encountered. Documentation helps guarantee transparency, accountability, and compliance with inside insurance policies and exterior laws.

- Carry out Reconciliation Controls: Implement reconciliation controls and procedures to stop future discrepancies and errors. This may occasionally embrace common evaluate and validation of monetary transactions, segregation of duties, approval workflows, and periodic audits.

- Monitor and Evaluation: Constantly monitor and evaluate the reconciliation course of to make sure ongoing accuracy and effectiveness. Recurrently assess the adequacy of reconciliation controls, determine areas for enchancment, and make essential changes to reinforce the effectivity and reliability of the method.

By following these step-by-step pointers, companies can successfully carry out expense reconciliation, keep correct monetary information, and mitigate the chance of errors, discrepancies, and fraud. Constant and thorough expense reconciliation practices are important for making certain monetary integrity, compliance, and knowledgeable decision-making inside organisations.

How Nanonets can 10x Your Expense Reconciliation Course of

Nanonets gives cutting-edge automation options that may revolutionise the expense reconciliation course of in your organization, agnostic of sector and dimension. Here is how Nanonets can enhance the effectivity, accuracy, and pace of your expense reconciliation:

Nanonets leverages superior OCR (Optical Character Recognition) expertise to mechanically extract knowledge from numerous monetary paperwork, together with financial institution statements, invoices, receipts, expense studies, bank card statements, and extra. By eliminating the necessity for guide knowledge entry, Nanonets accelerates the reconciliation course of and reduces the chance of human errors.

Nanonets’ AI-powered clever doc classification algorithms categorise and organise monetary paperwork based mostly on predefined standards, comparable to transaction kind, vendor identify, date vary, and quantity. This allows seamless sorting and grouping of paperwork, facilitating sooner and extra environment friendly reconciliation.

Nanonets lets you customise expense reconciliation workflows in response to your particular enterprise necessities and preferences. You may outline guidelines, thresholds, and validation standards to automate decision-making and exception dealing with, making certain a standardised but optimised reconciliation processes.

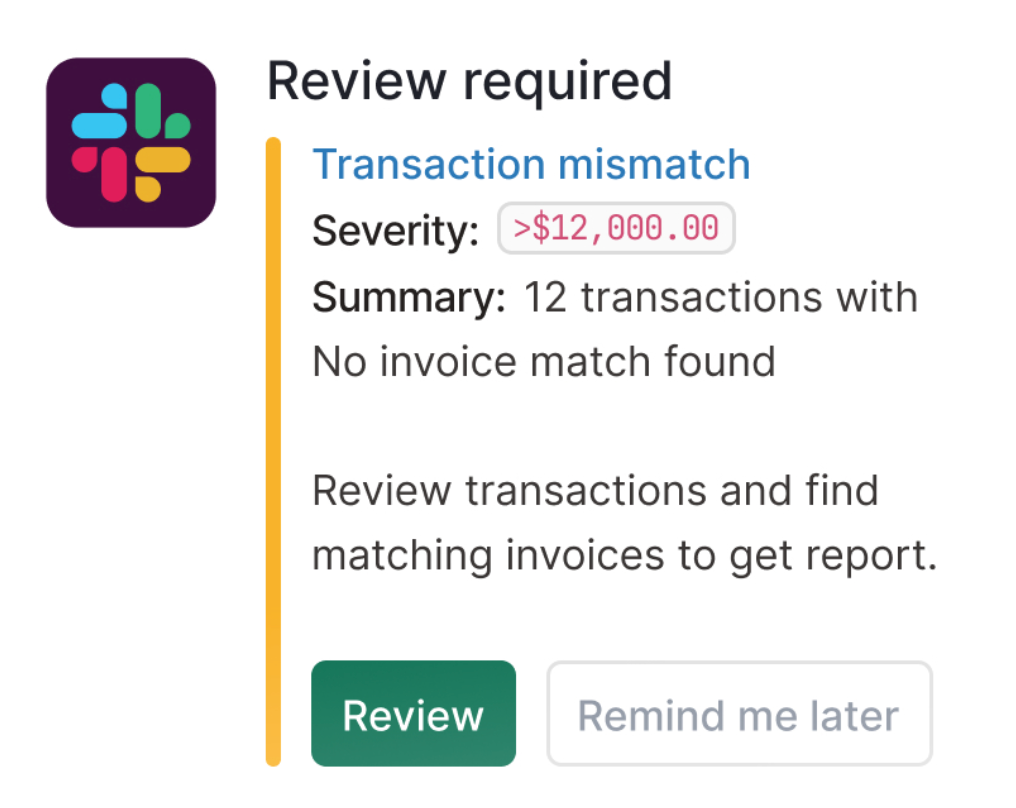

Nanonets offers real-time monitoring and alerts to maintain you knowledgeable in regards to the progress and standing of expense reconciliation actions. You may obtain notifications for accomplished reconciliations, pending duties, exceptions, discrepancies, or anomalies, permitting you to take well timed motion and deal with points proactively.

Nanonets simply integrates with present accounting programs, ERP (Enterprise Useful resource Planning) software program, and monetary administration platforms, which permits clean knowledge change and synchronisation. You may import/export reconciled knowledge, generate customized studies, and observe monetary metrics inside your most popular software program setting.

Whether or not you are a small enterprise or a big enterprise, Nanonets gives scalable and versatile options that may adapt to your evolving wants and rising quantity of monetary transactions. You may simply scale up or down your utilization, add new customers, or broaden performance to accommodate altering enterprise necessities.

Nanonets offers strong knowledge safety and compliance with {industry} requirements and laws, comparable to GDPR (Normal Information Safety Regulation) and HIPAA (Well being Insurance coverage Portability and Accountability Act). Your delicate monetary knowledge is encrypted, saved securely, and guarded towards unauthorised entry, guaranteeing confidentiality and integrity.

Moreover, Nanonets is dedicated to ongoing innovation and enhancement of its automation options to ship most worth and efficiency to prospects. You may profit from common updates, new options, and enhancements that optimise the expense reconciliation course of and drive operational excellence.

E book a free session name with Nanonets on your expense reconciliation wants right here. By leveraging Nanonets’ superior automation capabilities, you possibly can obtain vital positive factors in operational effectivity, value financial savings, and productiveness.

Expense Reconciliation: Challenges and Greatest Practices

Expense reconciliation is a crucial side of monetary administration, making certain the accuracy and integrity of an organisation’s monetary information. Nonetheless, it’s not with out its challenges: Some of the vital hindrances whereas reconciling bills is the reliance on guide knowledge entry for recording transactions and reconciling accounts. This course of is time-consuming, labour-intensive, and liable to errors, resulting in discrepancies in monetary information.

To deal with this problem, organisations can embrace automation applied sciences, comparable to AI-powered software program and robotic course of automation (RPA), to streamline and automate expense reconciliation duties. By automating knowledge extraction, categorization, matching, and validation, organisations can enhance effectivity, accuracy, and scalability whereas decreasing guide effort and errors.

Moreover, monetary knowledge may be complicated, particularly when coping with a number of currencies, cost strategies, and expense classes. Managing and reconciling various knowledge sources, codecs, and constructions can pose a big problem for organisations, significantly these working in world markets. To beat this, organizations can implement standardisation initiatives to standardise expense classes, coding conventions, reconciliation procedures, and documentation templates. By establishing clear pointers and protocols, organisations can minimise errors, confusion, and discrepancies in monetary information.

Compliance with regulatory requirements and reporting necessities provides one other layer of complexity to the expense reconciliation course of. Organisations should guarantee adherence to accounting rules, tax laws, and industry-specific pointers, which can fluctuate relying on the jurisdiction and enterprise sector. To deal with compliance challenges, organisations can implement strong inside controls, segregation of duties, and approval workflows to stop fraud, errors, and unauthorised transactions. By imposing strict adherence to insurance policies, procedures, and authorization protocols, organisations can mitigate dangers and keep compliance with regulatory requirements.

Restricted visibility into monetary transactions, bills, and reconciliation actions can hinder decision-making and accountability. With out real-time insights and analytics, organisations might wrestle to determine traits, anomalies, or areas for enchancment of their expense administration processes. To boost visibility, organisations can spend money on knowledge high quality administration initiatives to enhance the accuracy, completeness, and reliability of monetary knowledge. By implementing knowledge validation checks, error detection mechanisms, and knowledge cleaning methods, organisations can determine and rectify inconsistencies or inaccuracies in expense information.

Many organisations face useful resource constraints, together with funds limitations, staffing shortages, and technological gaps, which might impede their capability to carry out expense reconciliation successfully. With out adequate assets and assist, organisations might wrestle to implement greatest practices and undertake automation options. To deal with useful resource constraints, organisations can foster collaboration and communication between finance, procurement, and different departments concerned within the expense reconciliation course of. By selling cross-functional teamwork, data sharing, and transparency, organisations can facilitate alignment, coordination, and accountability.

In abstract, by addressing these challenges and implementing greatest practices, organisations can improve the effectiveness, effectivity, and reliability of their expense reconciliation course of. By embracing automation, standardisation, compliance, visibility, and collaboration, organisations can enhance monetary administration, compliance, and decision-making.

Conclusion

Expense reconciliation is a elementary side of monetary administration, enabling organisations to keep up accuracy, integrity, and compliance of their monetary information. Whereas the expense reconciliation course of might pose numerous challenges, comparable to guide knowledge entry, complexity, compliance necessities, restricted visibility, and useful resource constraints, organisations can overcome these obstacles by implementing greatest practices and leveraging expertise options.

By embracing automation, standardisation, compliance, visibility, and collaboration, organisations can streamline expense reconciliation duties, enhance effectivity, accuracy, and scalability, and improve decision-making and accountability. Automation applied sciences, comparable to superior AI-powered software program and OCR applied sciences like Nanonets, can automate knowledge extraction, categorization, matching, and validation, decreasing guide effort and errors.

Moreover, standardisation initiatives, inside controls, and knowledge high quality administration will help organisations guarantee consistency, accuracy, and compliance of their expense reconciliation processes. By imposing strict adherence to insurance policies, procedures, and authorization protocols, organisations can mitigate dangers and keep compliance with regulatory requirements.

Furthermore, fostering collaboration, communication, and transparency between finance, procurement, and different departments concerned within the expense reconciliation course of can facilitate alignment, coordination, and accountability. By selling cross-functional teamwork and data sharing, organisations can optimise useful resource allocation and maximise the effectiveness of their expense reconciliation efforts.

In conclusion, by addressing challenges, implementing greatest practices, and leveraging expertise options, organisations can optimise their expense reconciliation course of, improve monetary administration, compliance, and decision-making, and drive enterprise success.

[ad_2]

Supply hyperlink