[ad_1]

Unlocking Effectivity: A Information to Intercompany Reconciliation Software program

Trendy companies, with the predominance of distant work and globalised operations, typically need to cope with intercompany transactions. Managing such transactions may be cumbersome with out the correct instruments and options, nonetheless.

However intercompany reconciliation softwares are a solution to this problem, streamlining the method and making certain accuracy in monetary reporting. On this information, we’ll discover what intercompany reconciliation is, the high softwares out there, key options to contemplate earlier than shopping for one, pricing choices, and the way automated options like Nanonets can revolutionise your reconciliation course of.

What’s Intercompany Reconciliation?

Intercompany reconciliation is the method of balancing and reconciling monetary transactions between completely different entities or subsidiaries throughout the identical organisation. In multinational firms or conglomerates with a number of subsidiaries, intercompany transactions are frequent occurrences.

These transactions can embrace the switch of products, providers, or funds between affiliated corporations for numerous functions, akin to stock administration, shared providers, or financing actions. And intercompany reconciliation ensures that every one transactions between affiliated entities are precisely recorded, eliminating any discrepancies and errors in monetary reporting. The intercompany reconciliation course of includes evaluating and matching transactions recorded by every entity to make sure consistency and accuracy in monetary statements.

Key features of intercompany reconciliation embrace:

Identification of Intercompany Transactions:

Step one within the reconciliation course of is figuring out transactions that contain a number of entities throughout the group. These transactions are usually recorded individually by every entity and must be reconciled to make sure consistency in monetary reporting.

Matching of Transactions:

As soon as intercompany transactions are recognized, the following step is to match corresponding transactions recorded by every entity. This includes evaluating transaction particulars, akin to quantities, dates, and references, to make sure that they align throughout all entities concerned.

Decision of Discrepancies:

Inevitably, discrepancies might come up throughout the reconciliation course of attributable to timing variations, forex conversions, or different components. Resolving these discrepancies requires investigation and communication between the entities concerned to find out the right remedy and changes wanted.

Documentation and Reporting:

All through the reconciliation course of, it’s important to take care of complete documentation of all transactions and reconciliation actions. This documentation serves as an audit path and helps correct monetary reporting.

Intercompany reconciliation is a vital a part of making certain the integrity and accuracy of economic statements for multinational firms. However given the various sophisticated steps concerned, reconciling transactions between affiliated entities and organisations can turn out to be tedious. Luckily, there exist softwares and options that assist corporations effectively carry out intercompany reconciliation whereas sustaining transparency and compliance by means of their monetary reporting processes.

What are the options of Intercompany Reconciliation Software program?

Intercompany reconciliation software program is a specialised resolution designed to streamline and automate the intercompany reconciliation course of inside organisations. This software program supplies instruments and functionalities to facilitate the identification, matching, and determination of intercompany transactions, thereby making certain accuracy and consistency in monetary reporting throughout a number of entities or subsidiaries.

Intercompany reconciliation software program usually gives the next options and capabilities:

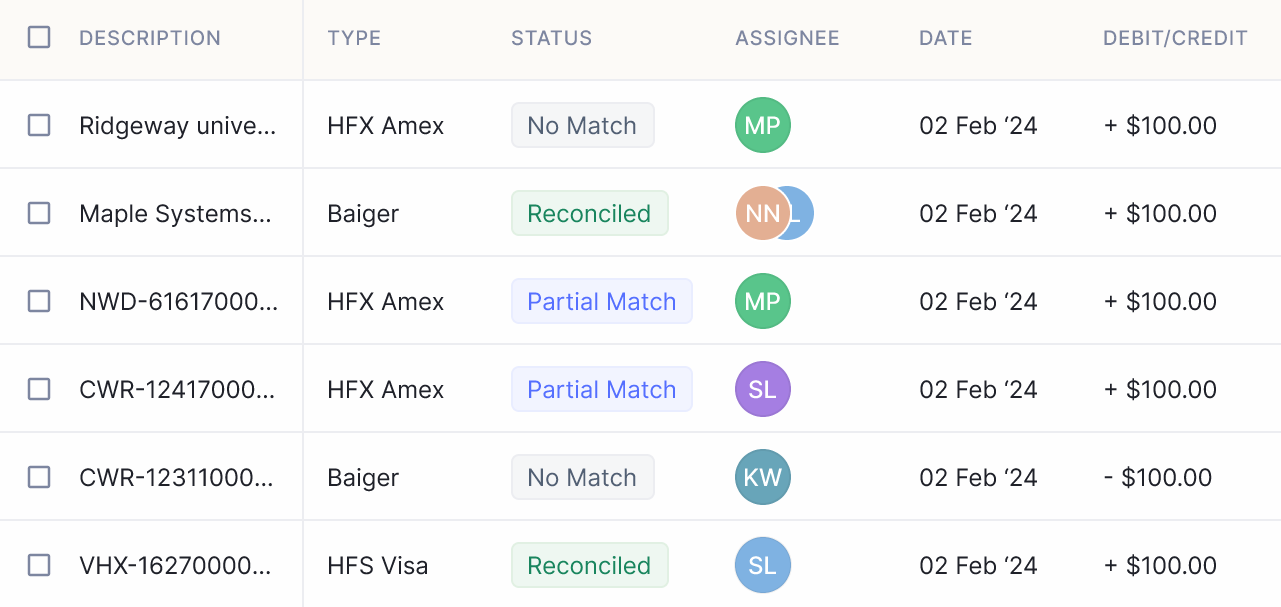

- Transaction Matching: Superior algorithms and matching logic allow the software program to routinely evaluate and match intercompany transactions recorded by completely different entities. This matching course of helps establish discrepancies and inconsistencies that require additional investigation.

- Automated Workflows: The software program automates numerous features of the reconciliation course of, together with the routing of unmatched transactions to the suitable personnel for decision. Automated workflows streamline the reconciliation course of, scale back handbook effort, and enhance effectivity.

- Exception Dealing with: Intercompany reconciliation software program consists of options for managing exceptions and discrepancies recognized throughout the matching course of. It permits customers to classify, prioritise, and observe unresolved objects, making certain well timed decision and stopping bottlenecks within the reconciliation workflow.

- Audit Path: Complete audit path performance supplies visibility into all reconciliation actions, from transaction matching to decision. This audit path helps organisations keep compliance with regulatory necessities and supplies transparency for inside and exterior audits.

- Reporting and Analytics: Sturdy reporting and analytics capabilities allow customers to generate customised experiences and dashboards to observe reconciliation efficiency, observe key metrics, and establish tendencies or patterns in intercompany transactions.

- Integration with ERP Methods: Intercompany reconciliation software program seamlessly integrates with current enterprise useful resource planning (ERP) methods, permitting for the seamless alternate of knowledge and data. Integration ensures information consistency and accuracy throughout monetary methods and processes.

- Scalability and Flexibility: Trendy intercompany reconciliation software program is scalable and versatile, able to supporting the reconciliation wants of organisations of all sizes and complexities. It may well adapt to evolving enterprise necessities and accommodate rising transaction volumes.

By leveraging intercompany reconciliation software program, organisations can streamline their reconciliation processes, enhance accuracy and effectivity, and scale back the chance of errors and discrepancies in monetary reporting. Intercompany reconciliation software program empowers finance groups to give attention to extra value-added actions, whereas automating the repetitive elements of intercompany reconciliation.

Prime Intercompany Reconciliation Softwares

A number of respected software program suppliers provide intercompany reconciliation options, every with its personal distinctive options and advantages, appropriate to varied sorts of companies. Listed here are a few of the high instruments on this class:

- Tookitaki

- Key Options: Superior AI-driven matching algorithms. Tookitaki’s intercompany reconciliation software program leverages synthetic intelligence (AI) and machine studying (ML) algorithms to automate the matching and reconciliation of intercompany transactions. This expertise ensures excessive accuracy and effectivity in figuring out discrepancies and resolving unmatched objects.

- Clients embrace monetary establishments, banks, and huge enterprises with complicated intercompany transaction volumes. Tookitaki’s software program is appropriate for organisations in search of to boost reconciliation accuracy, scale back handbook effort, and mitigate dangers related to intercompany transactions.

- Pricing: Tookitaki usually gives customised pricing primarily based on the particular wants and necessities of every organisation. Pricing might fluctuate relying on components akin to transaction quantity, consumer licences, and extra options.

- LucaNet

- Key Options: Built-in monetary consolidation and reporting. LucaNet’s intercompany reconciliation software program is a part of its complete company efficiency administration (CPM) suite, which incorporates monetary consolidation and reporting functionalities. This integration permits organisations to handle intercompany transactions seamlessly throughout the broader context of economic planning, evaluation, and reporting.

- Clients embrace medium to giant enterprises throughout numerous industries, together with manufacturing, retail, and providers, profit from LucaNet’s built-in CPM resolution. The software program caters to organisations in search of to streamline intercompany reconciliation processes whereas gaining insights into monetary efficiency and compliance.

- Pricing: LucaNet usually gives subscription-based pricing fashions tailor-made to the scale and complexity of every organisation. Pricing tiers might fluctuate primarily based on components akin to consumer licences, information quantity, and extra modules or providers.

- LucaNet is a highly-rated product on G2 and Capterra, the place customers worth it for its analytical capabilities and complete CPM options.

- SoftLedger

- Key Function: Actual-time visibility and analytics. SoftLedger’s intercompany reconciliation software program supplies real-time visibility into intercompany transactions and balances, enabling finance groups to observe reconciliation progress and analyse transaction information successfully. The software program consists of customizable dashboards and reporting instruments for detailed insights into intercompany monetary actions.

- Clients embrace small to midsize companies (SMBs) and rising enterprises on the lookout for a user-friendly and scalable resolution for intercompany reconciliation. SoftLedger caters to organisations in search of to enhance reconciliation accuracy and effectivity with out the complexity and overhead of conventional enterprise software program.

- Pricing: SoftLedger gives clear and aggressive pricing plans designed to accommodate the funds and necessities of SMBs and rising enterprises. Pricing might embrace subscription-based fashions with tiered pricing primarily based on options, consumer licences, and help choices.

- SoftLedger is a highly-rated product by customers on G2 and Capterra, particularly valued for its well timed help.

What to Search for in Intercompany Reconciliation Software program

When evaluating intercompany reconciliation software program, think about your group’s particular wants and necessities. Relying on the scale of your corporation and its particular monetary reporting wants, there could also be a number of eligible instruments.

A number of frequent options to search for in Intercompany Reconciliation Software program, nonetheless, are:

- Scalability: Make sure the software program can accommodate your organisation’s progress and evolving wants. Search for options that may deal with rising transaction volumes and help a number of entities or subsidiaries as your corporation expands.

- Integration: Seamless integration with current methods and software program is essential for sustaining information consistency and accuracy. Select a reconciliation device that may combine along with your ERP (Enterprise Useful resource Planning) system, accounting software program, and different monetary purposes to streamline information switch and decrease handbook information entry.

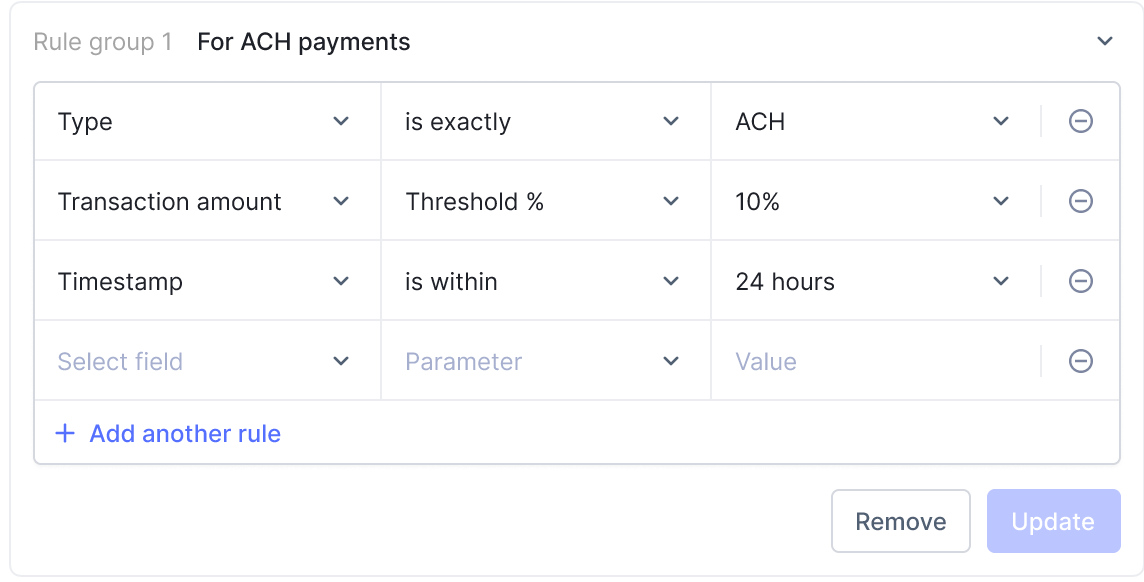

- Customization: The flexibility to customize workflows and experiences is important for tailoring the reconciliation course of to match your organisation’s distinctive necessities. Search for software program that provides versatile configuration choices, permitting you to outline customized guidelines, templates, and approval workflows primarily based in your particular enterprise processes.

- Assist and Coaching: Entry to complete help and coaching sources is important to maximise the software program’s effectiveness. Select a vendor that gives ongoing technical help, coaching classes, and consumer documentation to assist your group shortly be taught the system and deal with any points or questions which will come up throughout implementation and use.

How Nanonets can Automate Intercompany Reconciliation

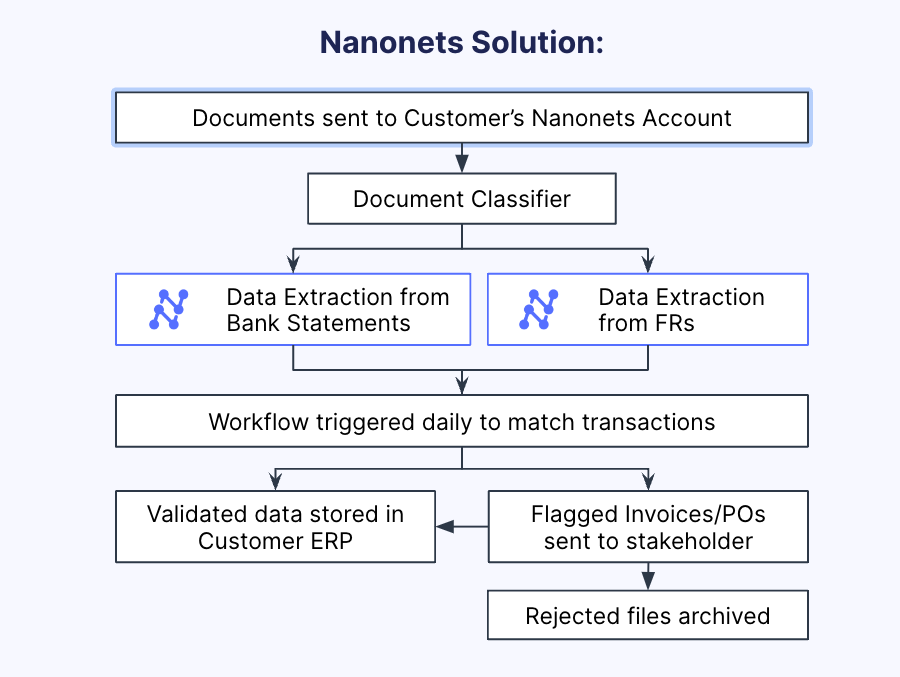

Superior automation applied sciences like Nanonets leverage synthetic intelligence (AI) and machine studying (ML) to streamline the reconciliation course of. This is how:

Automated Transaction Matching: Nanonets’ Optical Character Recognition (OCR) expertise can routinely match intercompany transactions primarily based on predefined standards, akin to transaction quantities, dates, and reference numbers. This eliminates the necessity for handbook matching and reduces the chance of errors or discrepancies.

Discrepancy Detection: Nanonets’ AI algorithms can detect discrepancies or anomalies in intercompany transactions, akin to lacking or mismatched information, duplicate entries, or unauthorised transactions. By flagging these discrepancies early on, the software program permits finance groups to research and resolve points promptly, making certain correct monetary reporting.

Environment friendly Reporting and Analytics: Nanonets’ automation options generate detailed experiences and analytics primarily based on intercompany transactions, offering beneficial insights into monetary efficiency, money stream, and compliance. These experiences may also help finance groups establish tendencies, observe KPIs (Key Efficiency Indicators), and make knowledgeable enterprise choices primarily based on real-time information.

Time and Value Financial savings: By automating repetitive reconciliation duties, akin to information entry, matching, and reporting, AI-powered instruments can save beneficial time and sources for finance groups. This permits finance professionals to give attention to higher-value actions, akin to monetary evaluation, strategic planning, and decision-making, driving better effectivity and productiveness throughout the organisation.

On this method, Nanonets can vastly enhance the organisation’s intercompany reconciliation software program.

Conclusion

Intercompany reconciliation is the method of balancing and reconciling monetary transactions between completely different entities and subsidiaries of the identical organisation. Intercompany reconciliation software program performs a significant function in making certain monetary accuracy and transparency by means of this course of, particularly for companies with complicated constructions and intercompany transactions.

By leveraging superior expertise and automation instruments like Nanonets, companies can streamline the reconciliation course of, enhance accuracy, and obtain better monetary transparency. By way of this information, we explored the important thing options and issues for choosing the correct intercompany reconciliation software program, in addition to the advantages of a number of top-of-the-market automated options, together with Nanonets. From scalability and integration to customization and help, it is important to decide on an intercompany reconciliation software program that aligns along with your organisation’s particular wants and necessities.

[ad_2]

Supply hyperlink