Enterprise homeowners more and more leverage single-source platforms like QuickBooks for varied monetary and enterprise processes, together with primary accounting, time monitoring, payroll, and extra.

QuickBooks affords a variety of how to obtain funds, from easy (direct invoicing) to advanced (like guide entries and bodily card swipes) funds. For these seeking to nest their fee processing workflow into their broader accounting panorama, QuickBooks probably has what you want – and, if not, third-party integrations serve to fill the gaps and customise your expertise.

What Cost Options Does QuickBooks Provide?

QuickBooks affords two major methods to obtain funds:

- Bill administration on Quickbooks On-line

- Extra add-on instrument known as QuickBooks funds.

We shall be discussing each of those on this weblog and take the expertise to subsequent degree.

For these not all in favour of managing funds by way of QuickBooks, don’t fret – QuickBooks affords third-party integrations to sync exterior fee knowledge from Sq., Stripe, and related fee processors to maintain your books aligned and correct.

Obtain Funds in QuickBooks On-line (With out QuickBooks Cost)

QuickBooks Cost tends to be the most well-liked possibility for these all in favour of a sturdy, full point-of-sale system. Nevertheless, smaller companies, sole proprietorships, and freelancers typically stick to QuickBooks’ baseline bill fee system.

Receiving fee by way of the invoicing technique is easy.

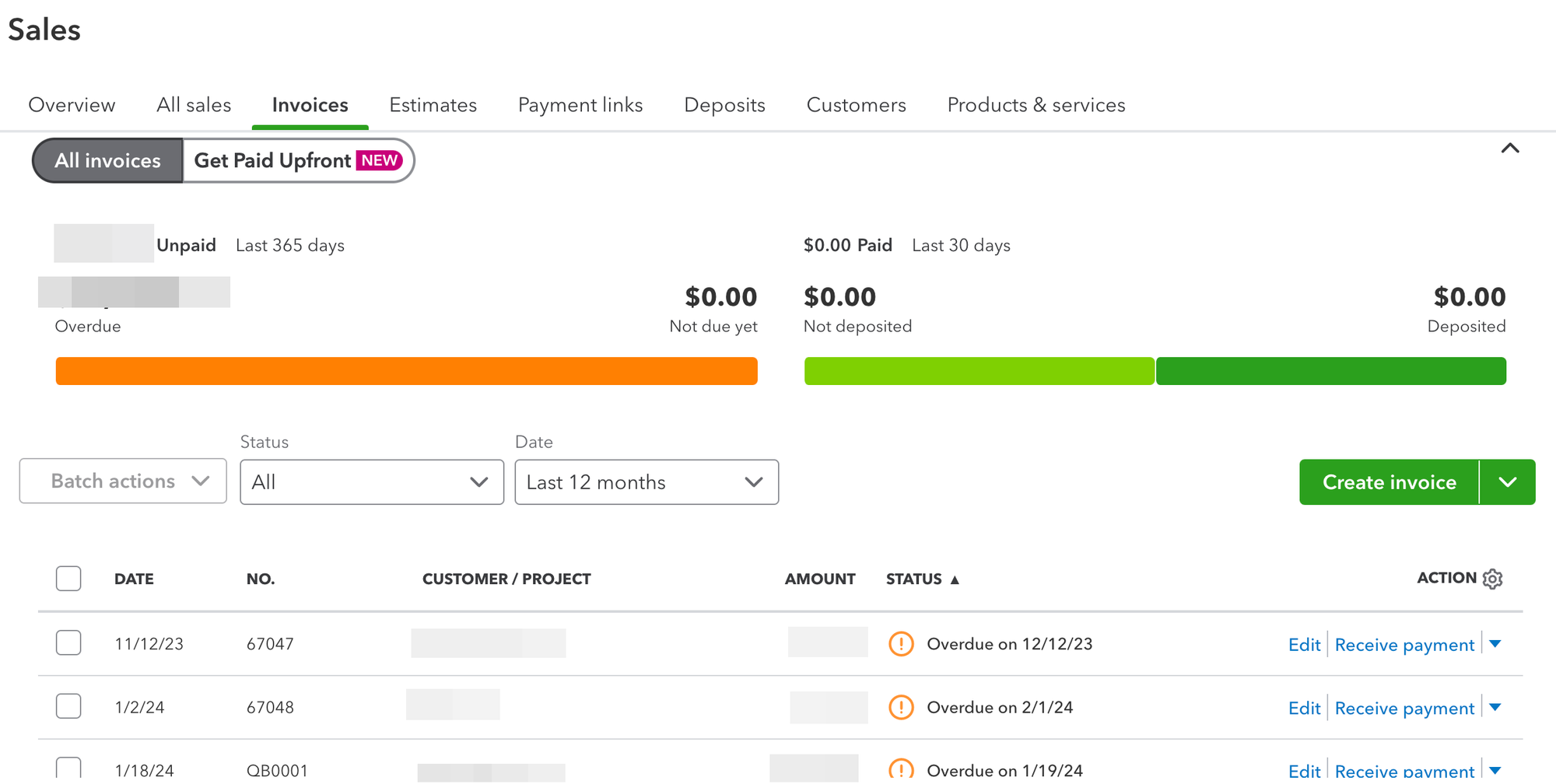

- First, navigate to the Gross sales web page in QuickBooks On-line. You’ll see current invoices (if in case you have any), however for now, we’ll create a brand new one by clicking Create Bill.

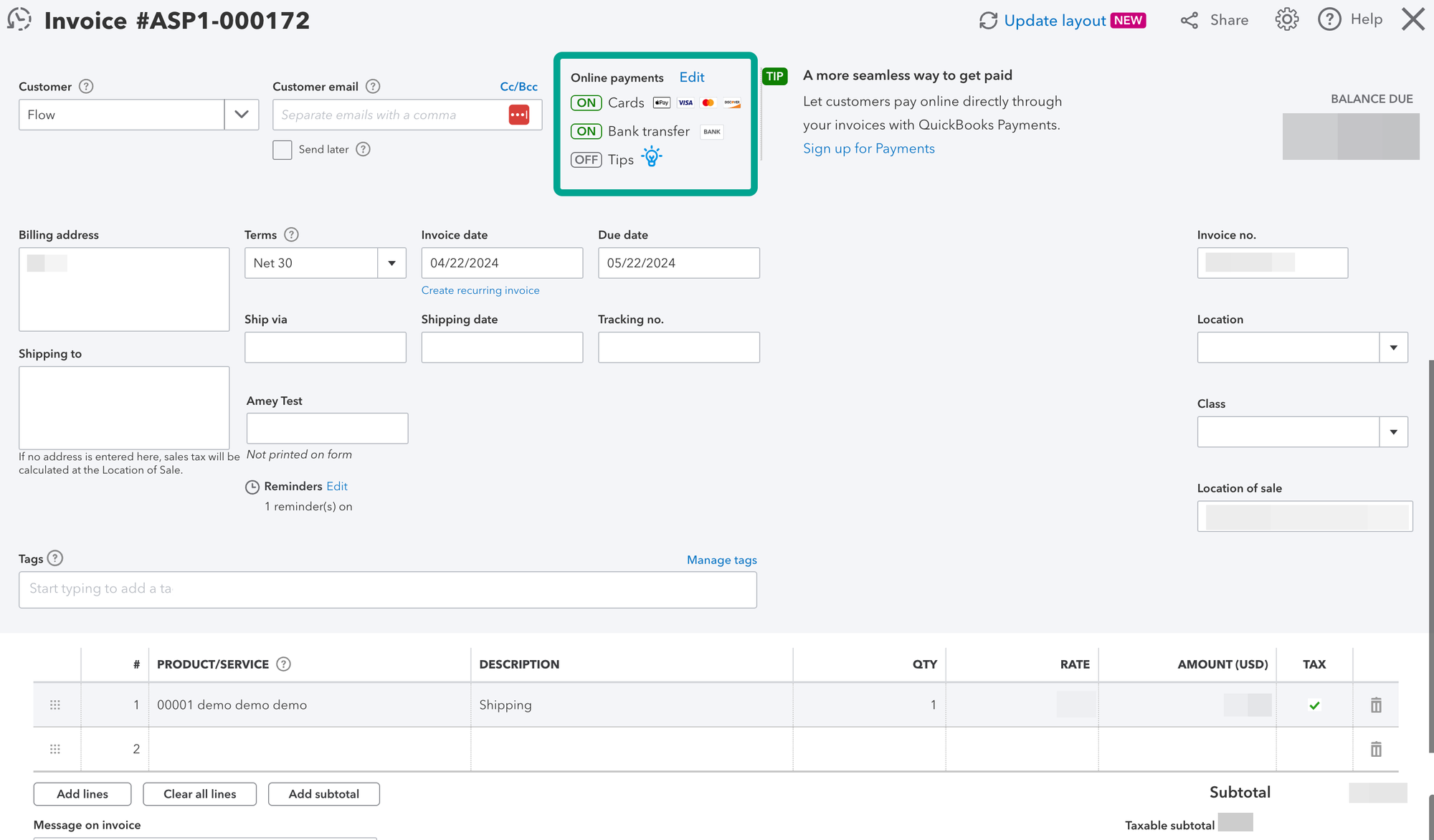

- You’ll then fill out buyer knowledge and click on Assessment and Ship.

- You’ll then be taken to a assessment window to validate the data and see the bill from the shopper’s perspective.

- You’ll additionally see the vary of fee choices your buyer has, together with bank cards, ACH switch, PayPal, and Venmo.

And that’s it! Utilizing the invoicing function to obtain fee in QuickBooks is easy and well-suited for primary wants. QuickBooks Funds fills the hole for these needing extra backend help or advanced fee necessities.

Customers ought to be aware that reconciliation and processing to your books, on this case, should not computerized—solely QuickBooks Funds affords computerized accounting. To document the fee, you need to mark the bill as paid upon reception (full or partial).

Guide Cost Recording in QuickBooks

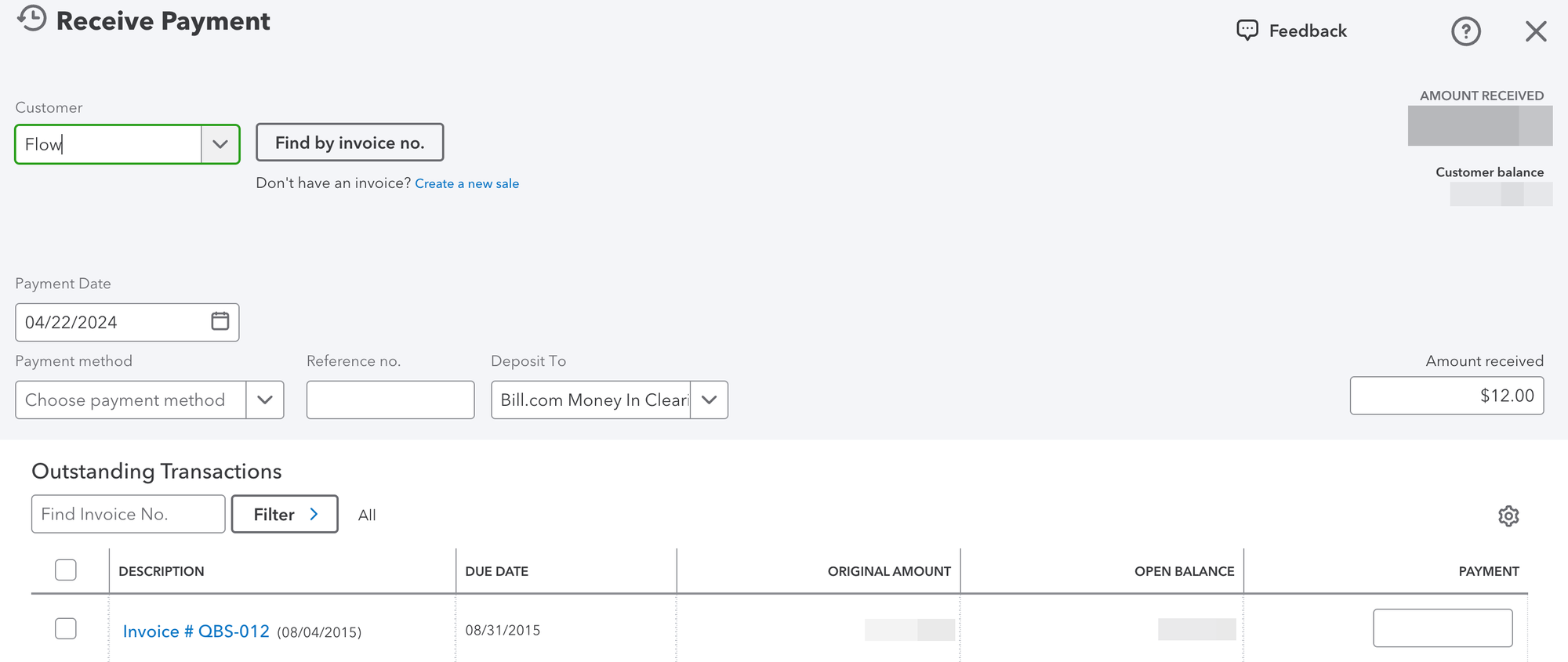

You need to use guide recording if you happen to don’t have QuickBooks Funds and prospects favor money, verify, or different offline funds. The method is easy, as at all times:

- First, navigate to Obtain Funds and choose the related guide fee technique:

- Within the above display screen, you’ll additionally fill out related buyer knowledge within the fields and hyperlink it to current invoices, if any.

- Then you definately’ll save and shut, however do not forget that you’ll must manually handle the books from this level onward as the method isn’t automated.

Streamline Funds with QuickBooks Funds

For these needing a bit extra robustness from their QuickBooks fee reception expertise, QuickBooks Funds affords a variety of options that go well with bigger companies coping with a flood of invoicing or funds.

QuickBooks Funds is an all-in-one fee processing platform that gives:

- Bodily bank card swipes or chip reads

- Commonplace on-line invoicing

- Guide bank card entry

- Recurring funds and bank card expenses

QuickBooks Funds additionally automates the fee reconciliation course of, routinely matching buyer funds to current invoices and drastically lowering guide administration. It additionally affords higher flexibility to permit prospects to “Pay Now” on-line by way of digital invoicing (proven above) or direct card funds, finally rising your means to maintain money coming in.

Receiving Funds by way of QuickBooks Funds

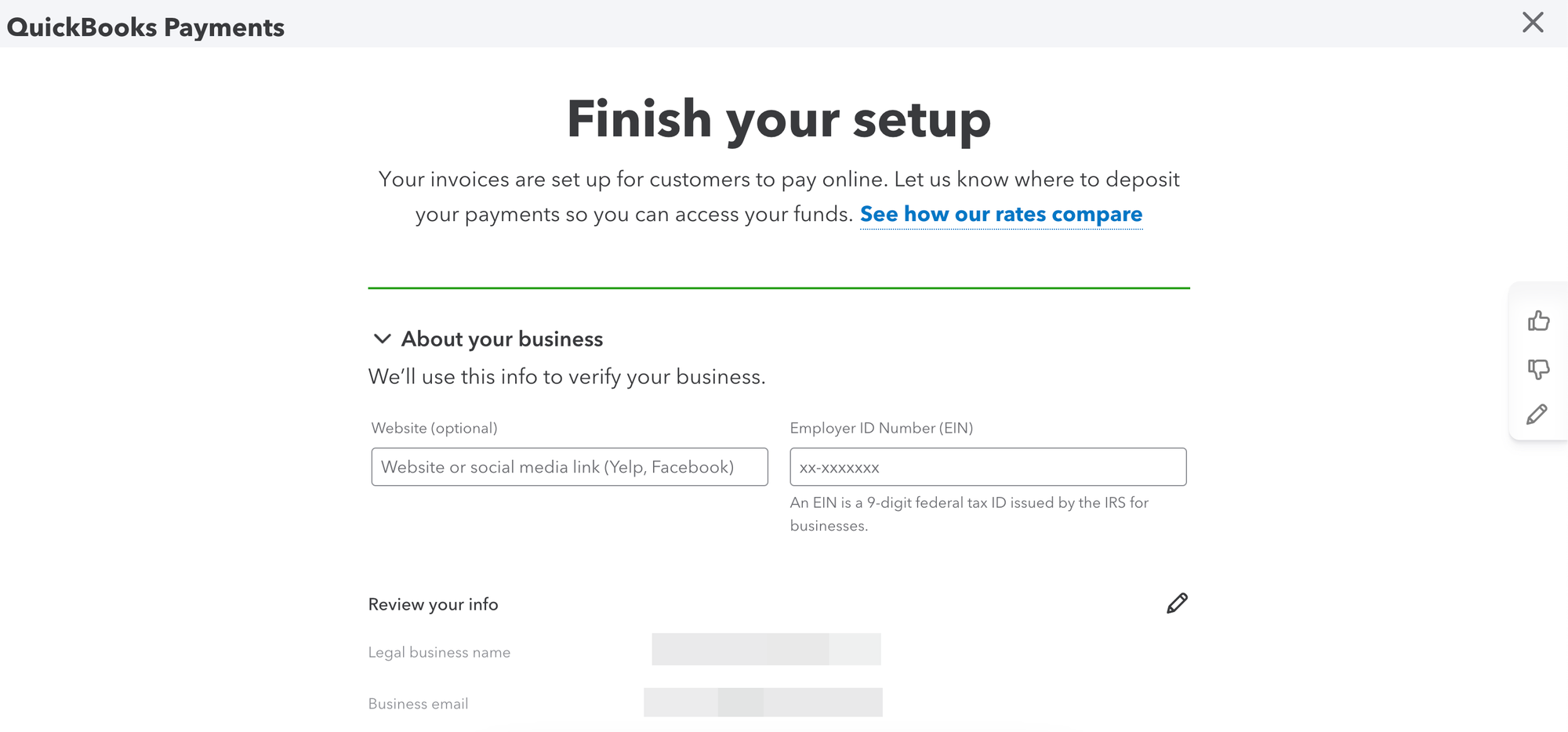

To obtain funds by way of QuickBooks Funds, you’ll first want to use and register for the service:

- From the first signup window, you’ll fill out some primary enterprise info (now all companies are eligible for QuickBooks Funds), proprietor info, and which account you like funds to be deposited to.

- At this level, you’ll have the choice to make use of QuickBooks Checking or choose a pre-existing exterior account. QuickBooks makes use of API integration to verify checking account possession, so it’s comparatively fast.

As soon as signed up, you’ll validate that QuickBooks Funds is linked to the right core product—it’ll be whichever you signed up by way of. For those who use a number of merchandise, make sure you navigate from the one you want to hyperlink to QuickBooks Funds (for instance, don’t join with QuickBooks Self-Employed if you happen to use the product however wish to hyperlink Funds to a QuickBooks On-line enterprise).

Now you’re able to obtain funds! Prospects pays utilizing bank cards, ACH transfers, and extra utilizing the digital invoicing system detailed above and direct bank card swipes or guide card entry.

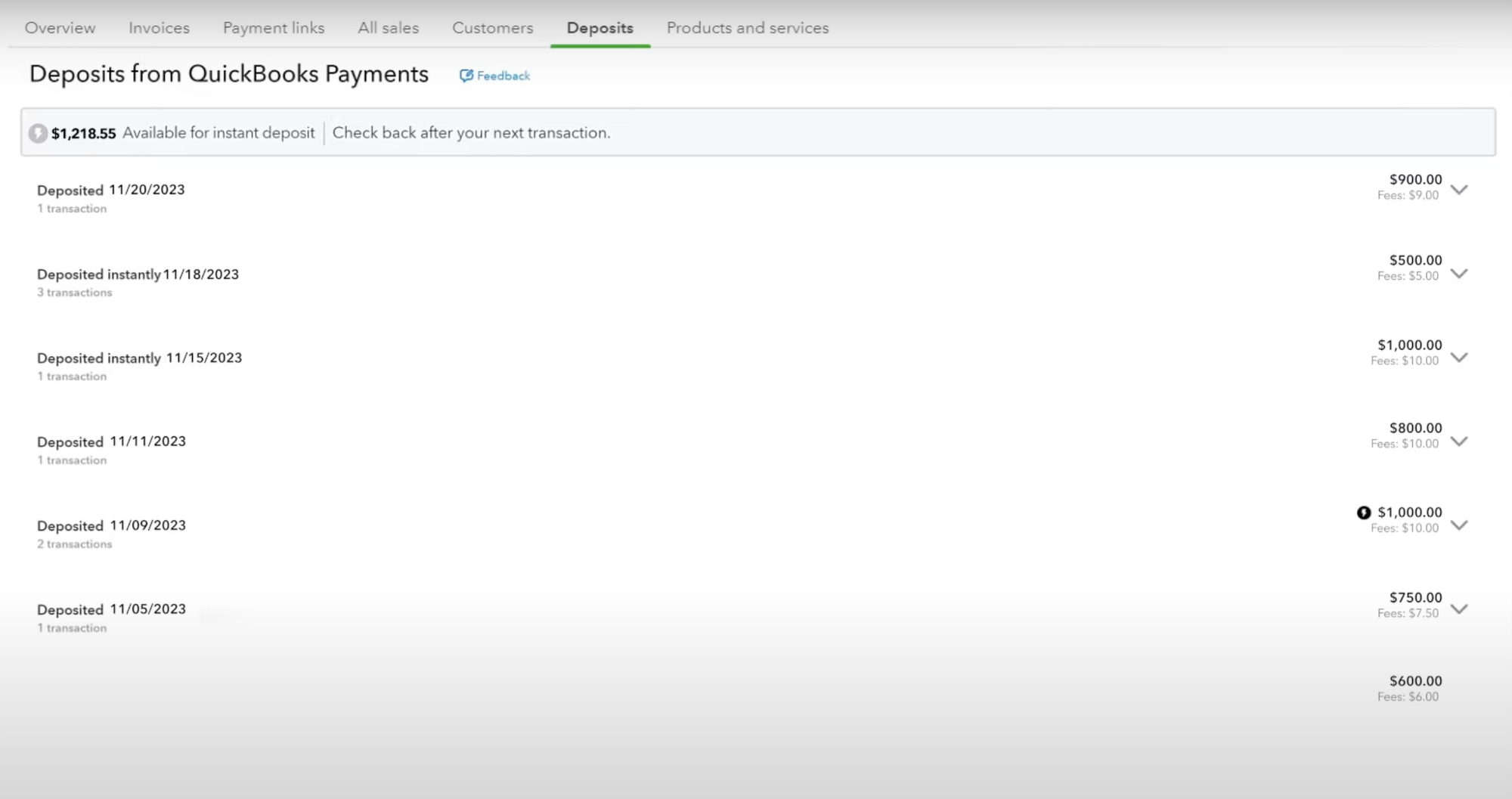

Within the Deposits tab underneath Gross sales, you possibly can see all of the deposits from Quickbooks Funds.

From there, QuickBooks Funds shines – it automates matching throughout your chart of accounts to avoid wasting time, particularly if you happen to’re processing tens of transactions each day (or extra!).

Utilizing Nanonets to Handle Funds in QuickBooks

To bridge the hole between QuickBooks On-line and QuickBooks Cost – or for these searching for a bit extra customization – Nanonets affords a third-party integration to automate accounts payable processing and financial institution reconciliation utilizing superior AI. On the identical time, Nanonets nests with Clever, Stripe, and extra fee processors with out “stepping up” to QuickBooks Funds if you happen to’d favor to not.

Nanonets additionally assist customers easy out tough edges throughout guide fee reception through the use of superior optical character recognition (OCR) to course of guide fee paperwork, whereas AI-driven processes automate matching and different accounting necessities that come up from guide funds.

Conclusion

Which technique you employ to simply accept funds in QuickBooks – normal, QuickBooks Funds, or guide – depends upon your particular enterprise wants. Whereas smaller companies and solo operations are inclined to do superb with direct invoicing by way of QuickBooks On-line, superior customers or bigger companies are inclined to benefit from the automation that comes with QuickBooks Funds to avoid wasting time and vitality whereas minimizing errors.

Regardless of which you select or mix of the numerous choices out there you create, QuickBooks’ means to maintain your fee ecosystem nested inside your wider monetary and accounting sphere is unmatched and serves to maintain your thoughts targeted on what issues – earning profits and increasing your small business.

And, after all, Nanonets acts as a complete third-party integration to bridge the hole between QuickBooks On-line and QuickBooks Funds for these needing a bit extra energy behind fee processing however might not be prepared for (or capable of afford) QuickBooks Funds.

![[2405.09584] Stressed Bandit Downside with Rewards Generated by a Linear Gaussian Dynamical System](https://i0.wp.com/arxiv.org/static/browse/0.3.4/images/arxiv-logo-fb.png?w=218&resize=218,150&ssl=1)