[ad_1]

Introduction to Financial institution Reconciliation Journal Entries

Financial institution reconciliation is a vital course of in accounting that ensures the accuracy and integrity of an organization’s monetary data. It includes the comparability between the corporate’s inner monetary data and people of the financial institution. On the coronary heart of this reconciliation lies the creation of journal entries, which serve to align discrepancies between the corporate’s books and the financial institution assertion. Understanding the intricacies of financial institution reconciliation journal entries is important for finance professionals and enterprise homeowners alike, because it empowers them to establish, handle, and forestall errors or discrepancies in monetary reporting. On this essay, we’ll take a look at the importance of financial institution reconciliation journal entries, discover widespread sorts of entries, and see how Nanonets will help in making certain accuracy and effectivity within the reconciliation course of.

Searching for a Reconciliation Software program?

Try Nanonets Reconciliation the place you’ll be able to simply combine Nanonets together with your present instruments to immediately match your books and establish discrepancies.

What’s Journal Entry in accounting?

A journal entry is a report of a monetary transaction that impacts the monetary statements of a enterprise. It is step one within the accounting cycle and includes recording the transaction within the common ledger.

Listed below are the important thing elements of a journal entry:

- Date: The date on which the transaction occurred.

- Accounts: The accounts affected by the transaction. Every journal entry includes at the very least two accounts: one account to be debited and one other account to be credited. Debits and credit are used to report will increase and reduces in particular accounts in accordance with the principles of double-entry accounting.

- Debit and Credit score Quantities: The quantities to be debited and credited to every account. Debits are recorded on the left facet of the journal entry, whereas credit are recorded on the fitting facet.

- Description/Narration: A short description or rationalization of the transaction, indicating the character of the transaction and offering context for the entry.

For instance, contemplate a enterprise that receives $1,000 in money for providers offered. The journal entry to report this transaction would sometimes appear like this:

On this journal entry:

- The “Money” account is debited as a result of the enterprise receives money, leading to a rise in money (an asset account).

- The “Service Income” account is credited as a result of the enterprise earns income from offering providers, leading to a rise in income (an fairness account).

The basic precept behind journal entries is the double-entry system, which ensures that the accounting equation (Belongings = Liabilities + Fairness) stays balanced. Each debit have to be accompanied by an equal and reverse credit score, thereby sustaining the equilibrium of the accounting equation.

Journal Entries in Financial institution Reconciliation

Within the means of financial institution reconciliation, numerous transactions require journal entries to make sure correct alignment between an organization’s monetary data and its financial institution assertion. Listed below are examples of such transactions and the corresponding journal entries:

- Financial institution Service Prices: When the financial institution imposes service prices, sometimes proven on the final day of the financial institution assertion, however not but mirrored within the firm’s books, a journal entry is important. This includes crediting the Money account and debiting an expense account reminiscent of Financial institution Prices or Miscellaneous Expense.

- Returned Buyer Checks (NSF): If checks deposited by clients bounce as a result of inadequate funds, leading to reversal of funds within the firm’s account, a journal entry is required to regulate the Money account and reverse the income initially recorded

- Financial institution Charges for Returned Checks: If the financial institution prices charges for returned checks, a journal entry is made to acknowledge this expense and cut back the Money account.

- Collections of Notes Receivable by the Financial institution: If the financial institution collects on the corporate’s behalf for notes receivable, a journal entry is important to acknowledge the rise in money.

- Curiosity Earned on Financial institution Accounts: When the financial institution pays curiosity on the corporate’s account, a journal entry is made to acknowledge this revenue.

Another gadgets that go into the journal are test printing prices, buyer checks that had been initially deposited however are subsequently returned as a result of inadequate funds (NSF), financial institution corrections addressing firm errors, mortgage funds, and digital deposits and withdrawals.

These journal entries assist be certain that the corporate’s monetary data precisely replicate the transactions reported by the financial institution, facilitating exact monetary reporting and sturdy inner controls.

Objective of Journal Entries in Financial institution Reconciliation

The first objective of journal entries in financial institution reconciliation is to align an organization’s inner monetary data with the transactions reported by the financial institution. Financial institution reconciliation ensures the accuracy and integrity of monetary information by figuring out and addressing discrepancies between the corporate’s data and the financial institution assertion. Journal entries facilitate changes to the corporate’s books to replicate transactions which have been recorded by the financial institution however not but by the corporate, or vice versa.

Listed below are some key functions of journal entries in financial institution reconciliation:

- Correcting Discrepancies: Journal entries assist right any variations between the corporate’s data and the financial institution assertion. These variations could come up as a result of excellent checks, deposits in transit, financial institution charges, curiosity earned, or different transactions that haven’t been precisely recorded or mirrored in each units of data.

- Guaranteeing Accuracy: By making essential changes by journal entries, financial institution reconciliation ensures that the corporate’s monetary data precisely replicate its true monetary place. This accuracy is important for making knowledgeable enterprise selections and assembly regulatory necessities.

- Strengthening Inner Controls: Financial institution reconciliation, supported by journal entries, serves as a necessary inner management mechanism. It helps detect errors, discrepancies, or potential fraud within the firm’s monetary transactions by evaluating data independently maintained by the financial institution and the corporate.

- Facilitating Determination-Making: Correct and up-to-date monetary data, achieved by efficient financial institution reconciliation and journal entries, present administration with dependable info for decision-making. Clear and reconciled monetary information allow administration to evaluate the corporate’s efficiency, handle money movement successfully, and plan for the longer term.

- Enhancing Monetary Reporting: Correctly reconciled monetary data, aided by journal entries, contribute to the preparation of correct monetary statements. These statements are important for stakeholders, together with buyers, collectors, and regulators, to judge the corporate’s monetary well being, efficiency, and compliance with accounting requirements.

The right way to Make Journal Entries in Financial institution Reconciliation?

Making journal entries in financial institution reconciliation includes a scientific strategy to make sure accuracy and alignment between an organization’s data and the financial institution assertion. Here is a step-by-step information on how you can make journal entries in financial institution reconciliation:

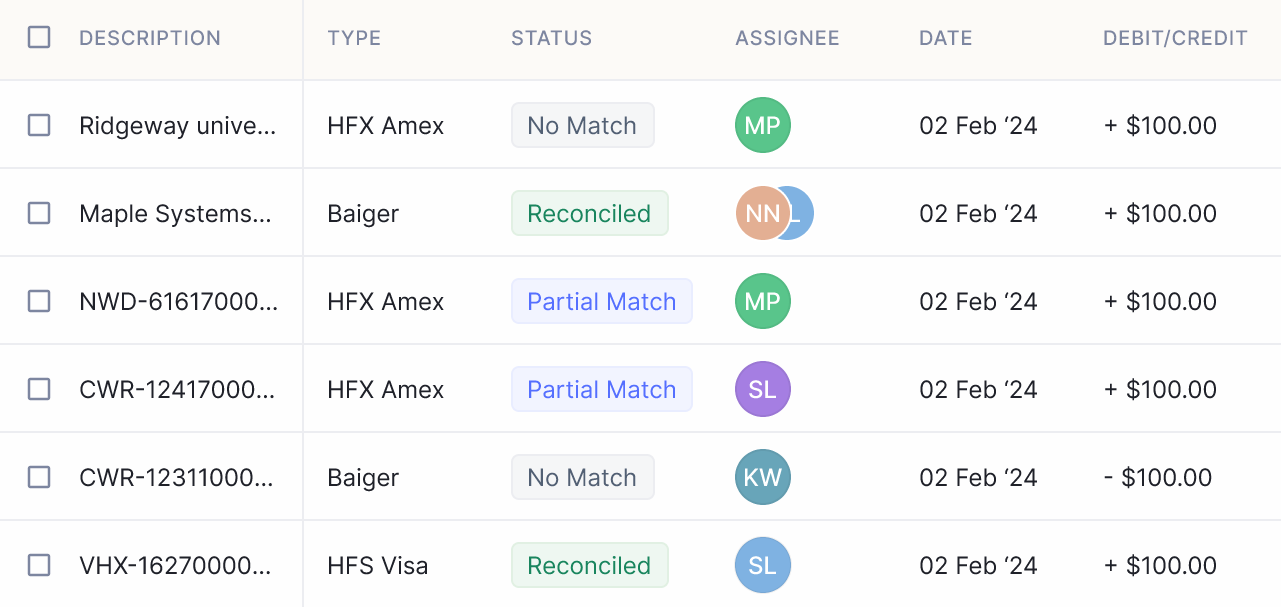

- Determine Discrepancies: Start by reviewing the financial institution assertion and evaluating it with the corporate’s inner data such because the Common Ledger to establish any variations or discrepancies. Frequent discrepancies embrace excellent checks, deposits in transit, financial institution charges, curiosity earned, or errors in recording transactions.

- Analyze Transactions: Analyze every recognized discrepancy to find out the suitable adjustment wanted within the firm’s books. Assess whether or not every merchandise requires a journal entry and whether or not it ought to be debited or credited based mostly on its nature.

- Select Accounts: Choose the accounts to be debited and credited for every journal entry. Debit accounts signify will increase in belongings or bills, whereas credit score accounts signify will increase in liabilities, fairness, or revenue. Guarantee accuracy by selecting the right accounts for every transaction.

- Decide Quantities: Calculate the quantities to be debited and credited for every journal entry. Confirm that the whole debits equal the whole credit to take care of the steadiness of the accounting equation. Take care to precisely decide the quantities to replicate the true influence of every transaction.

- Put together Journal Entries: Document the journal entries within the firm’s common ledger or accounting software program. Embrace the date of the entry, the accounts debited and credited, and a quick description of the transaction to offer readability and context. Double-check the accuracy of every entry earlier than continuing.

- Put up Entries: Put up the journal entries to the suitable accounts within the common ledger. Be sure that every entry is posted precisely to replicate the changes made within the firm’s data. Assessment the posting to verify that the balances are up to date appropriately.

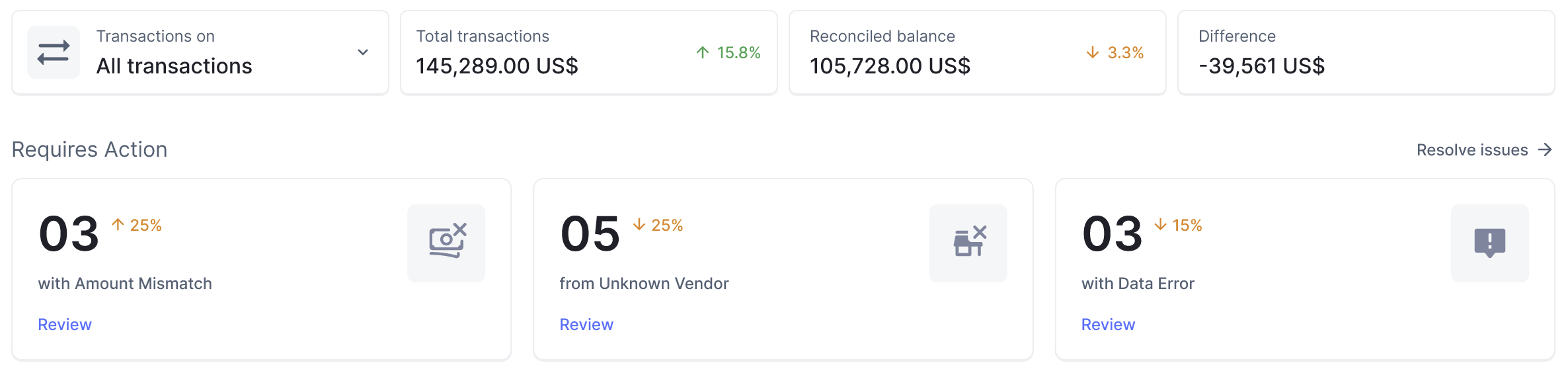

- Reconcile Balances: After finishing all journal entries, reconcile the adjusted balances with the financial institution assertion to make sure consistency between the corporate’s data and the financial institution’s data. Evaluate the reconciled balances to establish any remaining discrepancies which will require additional investigation or adjustment.

- Assessment and Verify: Assessment the finished financial institution reconciliation and journal entries to confirm accuracy and completeness. Verify that every one discrepancies have been addressed and resolved appropriately. Hold thorough documentation of the reconciliation course of for future reference and auditing functions.

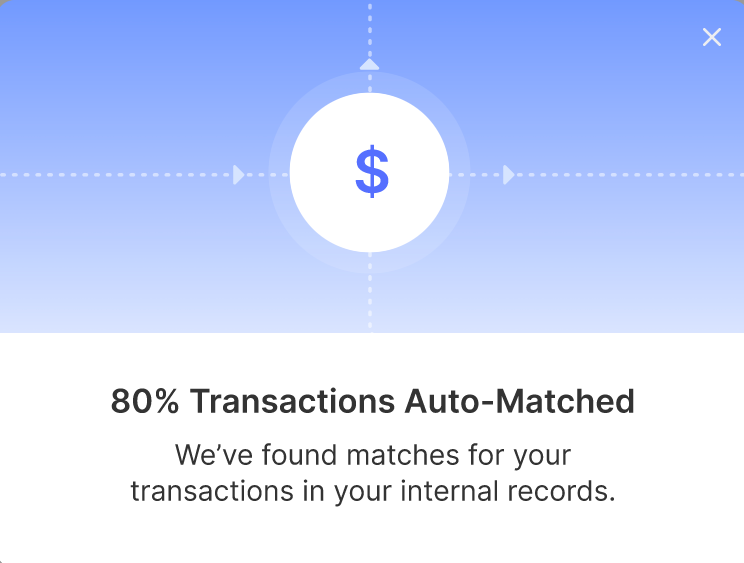

Streamlining Financial institution Reconciliation with Nanonets Automation

Nanonets can improve the effectivity and accuracy of the financial institution reconciliation course of by automating the creation of journal entries. Here is how Nanonets will help.

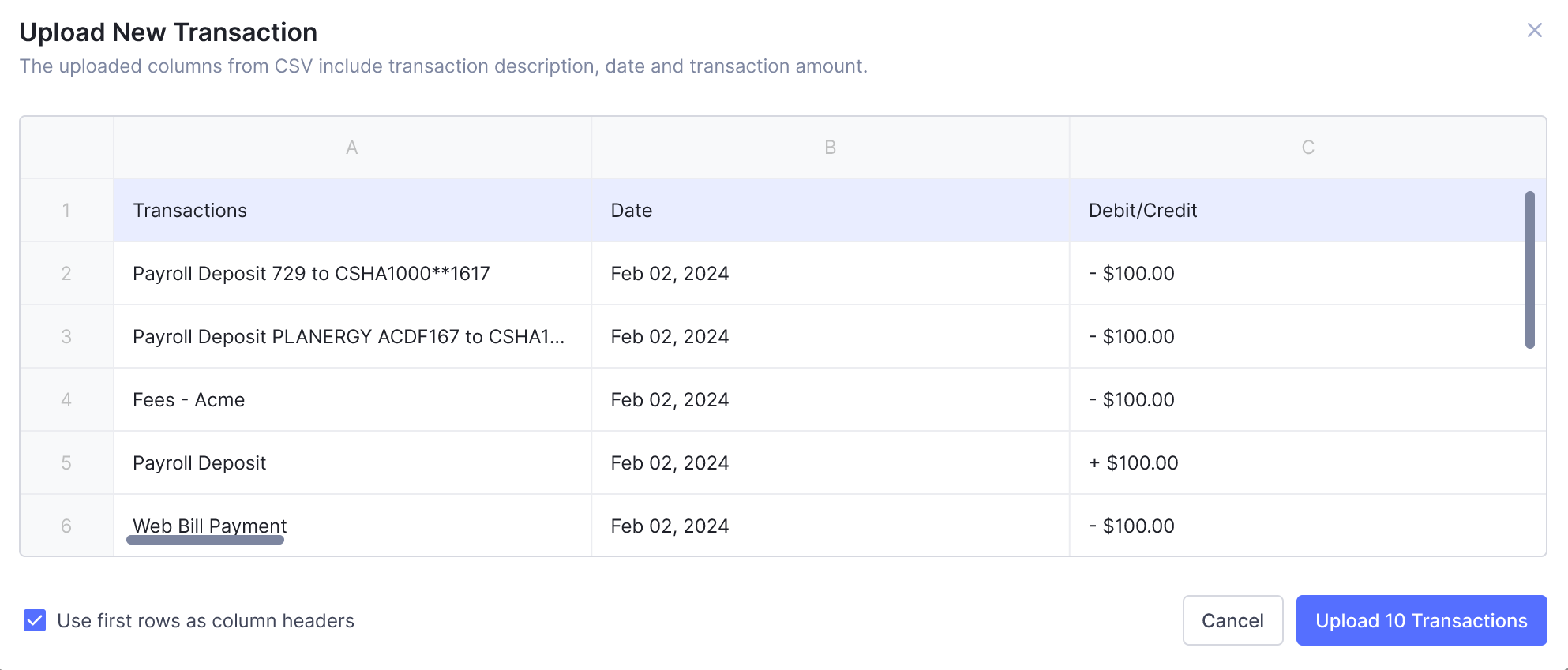

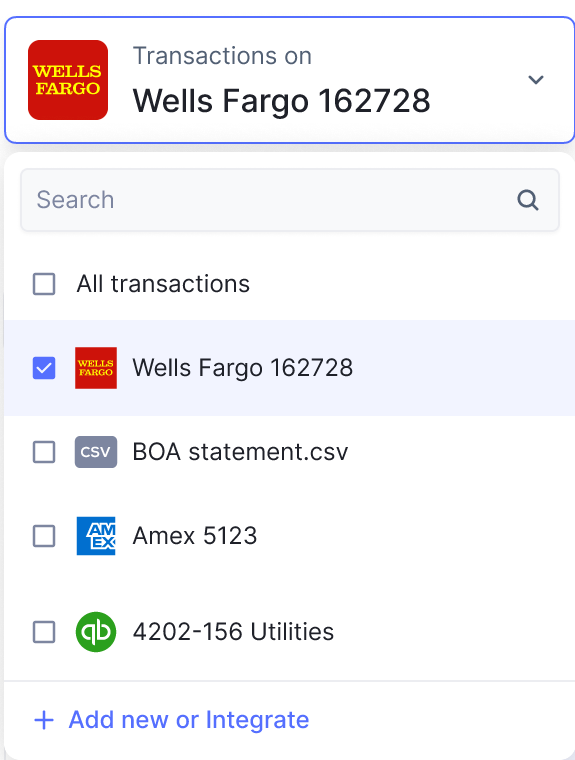

- Knowledge Extraction: Nanonets makes use of superior optical character recognition (OCR) expertise to extract related info from financial institution statements, together with transaction particulars reminiscent of dates, quantities, and transaction sorts.

- Integration with Accounting Software program: Nanonets seamlessly integrates with common accounting software program techniques, reminiscent of QuickBooks or Xero. This integration permits extracted information to be routinely transferred into the accounting software program, eliminating the necessity for guide information entry.

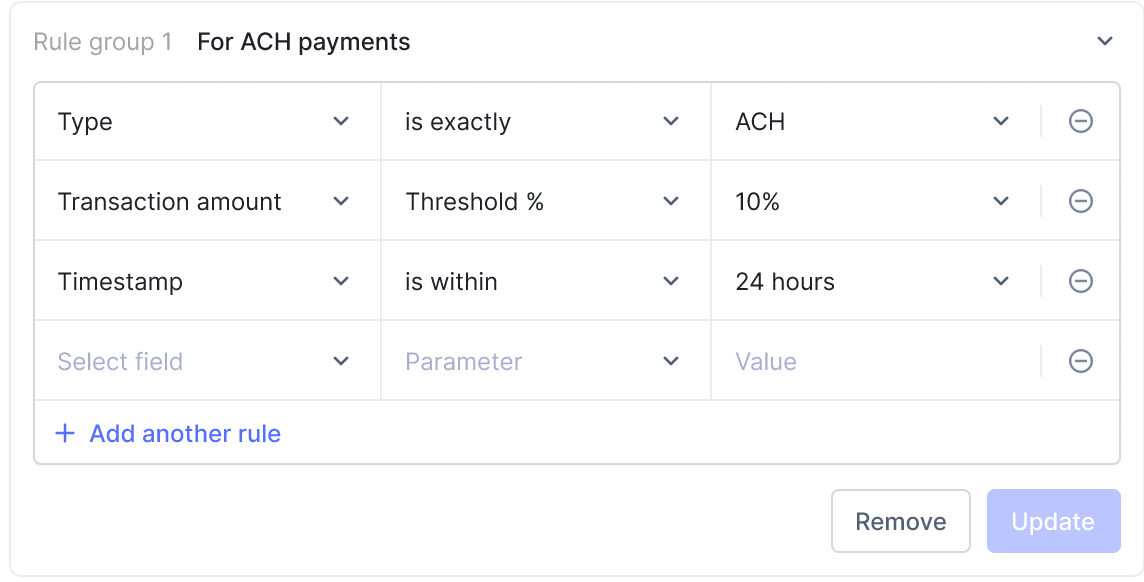

- Rule-based Classification: Nanonets employs machine studying algorithms to categorise transactions based mostly on predefined guidelines. For instance, it could distinguish between deposits, withdrawals, financial institution charges, and curiosity earned, making certain correct categorization of transactions.

- Automated Journal Entry Era: As soon as transactions are categorised, Nanonets routinely generates journal entries based mostly on predetermined guidelines and mappings. It debits and credit the suitable accounts, streamlining the journal entry creation course of.

- Customization and Flexibility: Nanonets affords customization choices to tailor the automation course of to the particular wants of the enterprise. Customers can outline guidelines, mappings, and approval workflows in accordance with their accounting practices and preferences.

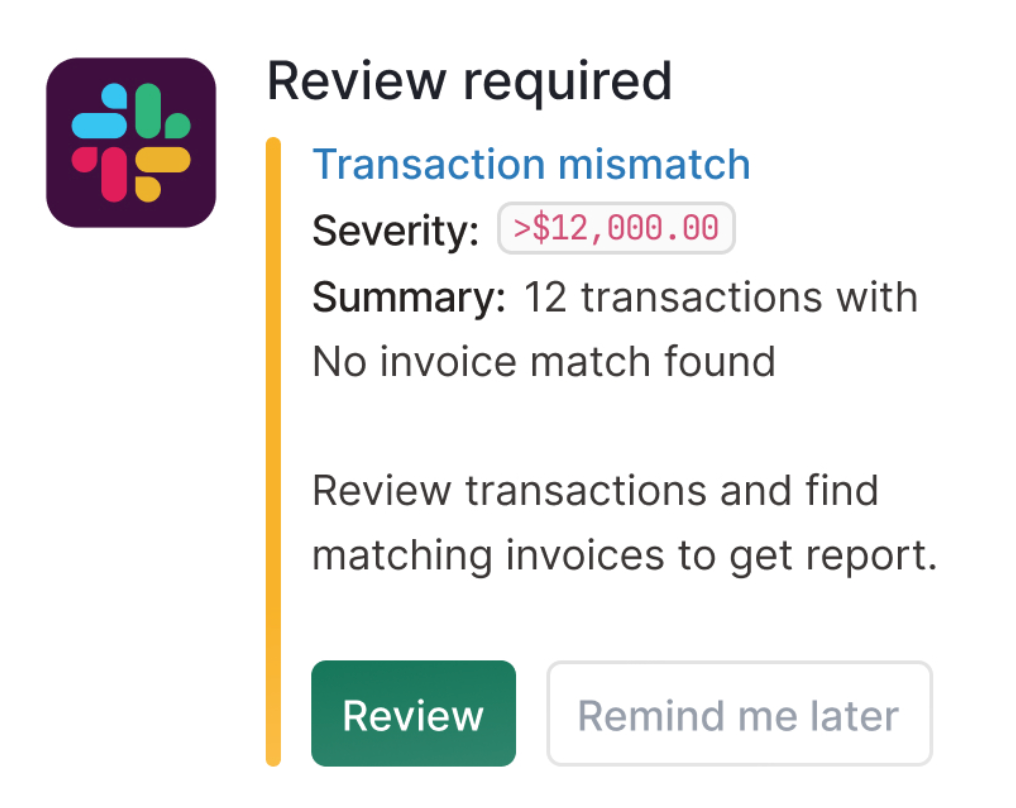

- Actual-time Updates and Alerts: Nanonets gives real-time updates and alerts on reconciled transactions, discrepancies, or exceptions. This permits well timed decision of points and ensures that the reconciliation course of stays environment friendly and up-to-date.

- Audit Path and Compliance: Nanonets maintains a complete audit path of all automated journal entries, offering transparency and accountability. This helps companies adjust to regulatory necessities and facilitates audit processes.

- Steady Enchancment: Nanonets leverages machine studying capabilities to constantly be taught from person suggestions and information patterns, bettering accuracy and effectivity over time. This iterative strategy ensures that the automation course of evolves to fulfill altering enterprise wants.

Take Away

The financial institution reconciliation journal helps in sustaining monetary integrity. By successfully reconciling firm data with financial institution statements and using instruments like Nanonets for automation, companies can streamline operations, cut back guide effort, and reduce errors. With correct and up-to-date monetary data, corporations could make knowledgeable selections, adjust to regulatory necessities, and drive sustainable development.

[ad_2]

Supply hyperlink