[ad_1]

Studying to reconcile with QuickBooks On-line is a beginning step for utilizing QuickBooks to handle books. QuickBooks is a useful instrument that can assist you reconcile your accounts with out utilizing any exterior instruments.

On this article, we stroll by means of the reconciliation course of in QuickBooks, deal with frequent points, and supply helpful suggestions.

Seek for “Reconcile” within the prime assist menu bar. Select the account you need to reconcile.

Step 2: Reconciliation Opening Stability

If you’re reconciling for the primary time, you have to discover out the opening and shutting date.

If the account was beforehand reconciled in QBO, you will discover the final reconciliation date from the “Historical past by account.” This can offer you the ending date for the final reconciliation.

Step 3: Reconciliation Closing Stability

Enter the closing steadiness and ending date. You may also choose so as to add the “service cost” and “curiosity earned’ fields.

Service Cost: Enter any service cost quantities imposed by your financial institution. Enter the info, quantity, and the expense account. You possibly can add an expense account like “Financial institution Service Costs.”

Curiosity earned: Fill the sphere to account for the curiosity earned out of your financial institution. Enter the info, quantity, and the expense account. You possibly can add an expense account like “Curiosity Earned.”

Step 4: Match and Clear Transactions

The QBO reconciliation display screen reveals a tick mark and gray background for cleared transactions. Whereas the unrivaled transactions seem on the prime.

For every unmatched transaction, discover the matching transaction in your assertion. If the quantity matches, clear the transaction. Repeat this course of until all of the transactions are matched. If the distinction hits 0, congratulations, your account is reconciled. Press “End Now” to finish the reconciliation.

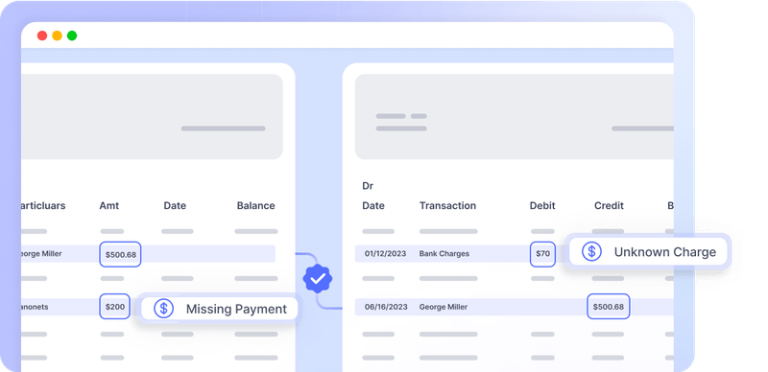

If the distinction will not be zero, you have to determine the transactions that aren’t recorded in QuickBooks. This may be resulting from accounting errors, unaccounted prices, or unauthorized transactions.

Figuring out errors in your reconciliation

1. Excellent Funds & Deposits

On account of banking delays, excellent checks and deposits-in-transit aren’t recorded within the financial institution assertion or will be recorded after the deadline. This may be unaccounted for in your financial institution assertion.

2. Accounting Entry Error:

Transaction quantities or dates will be incorrectly entered. This may result in a quantity mismatch, resulting in unmatched transactions.

3. Financial institution Costs or Curiosity Earned:

In case you haven’t accounted for this firstly, this will result in your financial institution steadiness reflecting a distinct quantity.

4. Unauthorized transactions, fraud or theft

Firms worldwide lose as much as 5% of their income to fraud and theft. This could possibly be resulting from unauthorized worker transactions or theft of bank card or checking account credentials. Reconciliation is a extremely useful course of to determine this and rapidly report it to safeguard the corporate from losses.

Automate Financial institution Assertion Reconciliation

Reconciling with QBO requires quite a lot of guide effort and will be time-consuming. This can be a greater drawback with corporations with excessive quantity and fast turnaround instances. Reconciling 100s of transactions can take days to resolve fully.

You possibly can scale back the reconciliation course of to minutes utilizing automation software program. This is able to require aggregating information from a number of monetary sources, extracting related information from paperwork, matching information throughout completely different sources, and fraud checks.

If you’re seeking to automate your financial institution reconciliation course of, arrange a demo name with our consultants to automate your workflows utilizing Nanonets.

Automate fraud detection, financial institution reconciliations or accounting processes with a ready-to-use customized workflow.

Reconciliation software program can automate 3 key gadgets for you:

- Information assortment – Automation software program like Nanonets can seamlessly combine together with your ERP or Electronic mail to assemble paperwork like cashbooks, financial institution statements, invoices, and receipts. The software program will solely pull related data from every doc by means of OCR know-how.

statements - Information matching – With no code automation, you possibly can simply arrange guidelines to match the 2 paperwork. You possibly can arrange new guidelines with time & don’t should battle with formulation.

- Figuring out error & fraud-check – Setup flags to determine any irregular transactions, duplicates, or unauthorized transactions.

[ad_2]

Supply hyperlink