Have to reconcile financial institution statements however bored with doing it manually? On the lookout for a financial institution assertion extraction software program? Look no additional as a result of we have now you lined.

We’ve researched and listed the ten greatest financial institution assertion extraction software program out there for 2024. Not simply that, you will see the professionals, cons and the pricing particulars for every, detailed within the article under.

Whether or not you’re a tax marketing consultant, a freelancer or a enterprise seeking to automate your financial institution assertion reconciliation workflow, our curated record will assist you discover the suitable software program for your self. However, earlier than we dive in, allow us to take a fast take a look at a comparative overview of the instruments summarised under:

| Software program | Professionals | Cons | Pricing |

|---|---|---|---|

| Nanonets | Excessive accuracy Finish-to-end automation Safe and scalable |

Pricey Potential studying curve AI could overfit |

Pay-as-you-go: $0.3/web page Professional: $999/mo Enterprise: Customized |

| FreshBooks | Person-friendly Integrates nicely with accounting options Appropriate for small companies |

Restricted OCR Not specialised for financial institution assertion extraction Fundamental reconciliation |

Lite: $19/mo Plus: $33/mo Premium: $60/mo |

| ProperSoft | Helps numerous codecs Value-efficient lifetime license Offline capabilities |

Sophisticated UI Restricted accuracy Costly lifetime license |

Month-to-month: $19.99 Yearly: $119.99 Lifetime: $199.99 |

| DextPrepare | Handles complicated codecs Scalable Sturdy safety |

Preliminary setup required Greater pricing for small companies |

Necessities: $229.99/mo Superior: $247.23/mo Customized |

| Infrrd | Excessive accuracy Handles massive volumes Customizable Scalable |

Preliminary setup time Challenges with non-standard paperwork Ongoing prices |

Fundamental: Customized Enterprise: Customized Enterprise Plus: Customized |

| Docuclipper | Optimized for financial institution assertion extraction Handles complicated paperwork Integrates with instruments |

Specialised for extraction Requires setup for customized codecs |

Starter: $39/mo Skilled: $74/mo Enterprise: $159/mo |

| Parseur | Simple to make use of Helps numerous codecs Versatile template creation |

Setup time Template limitations Restricted accuracy for complicated layouts |

Micro: $39/mo Mini: $69/mo Starter: $99/mo Premium: $199/mo |

| Parsio | Versatile Handles each digital and scanned paperwork Integrates with methods |

Handbook setup wanted Accuracy is dependent upon parsing guidelines Restricted monetary optimization |

Free: 100 credit/mo Starter: $49/mo Development: $149/mo Enterprise: $249/mo |

| Tremendous.AI | Customizable Excessive accuracy Scalable Human verification |

Vital setup Studying curve Greater pricing |

Customized pricing based mostly on volumes and customization |

| CaptureFast | Versatile Excessive accuracy Scalable Integrates with monetary workflows |

Setup and coaching wanted Not bank-statement centered Studying curve |

Free: 100 pages/mo Fundamental: $69/mo Skilled: $299/mo Enterprise: $799/mo |

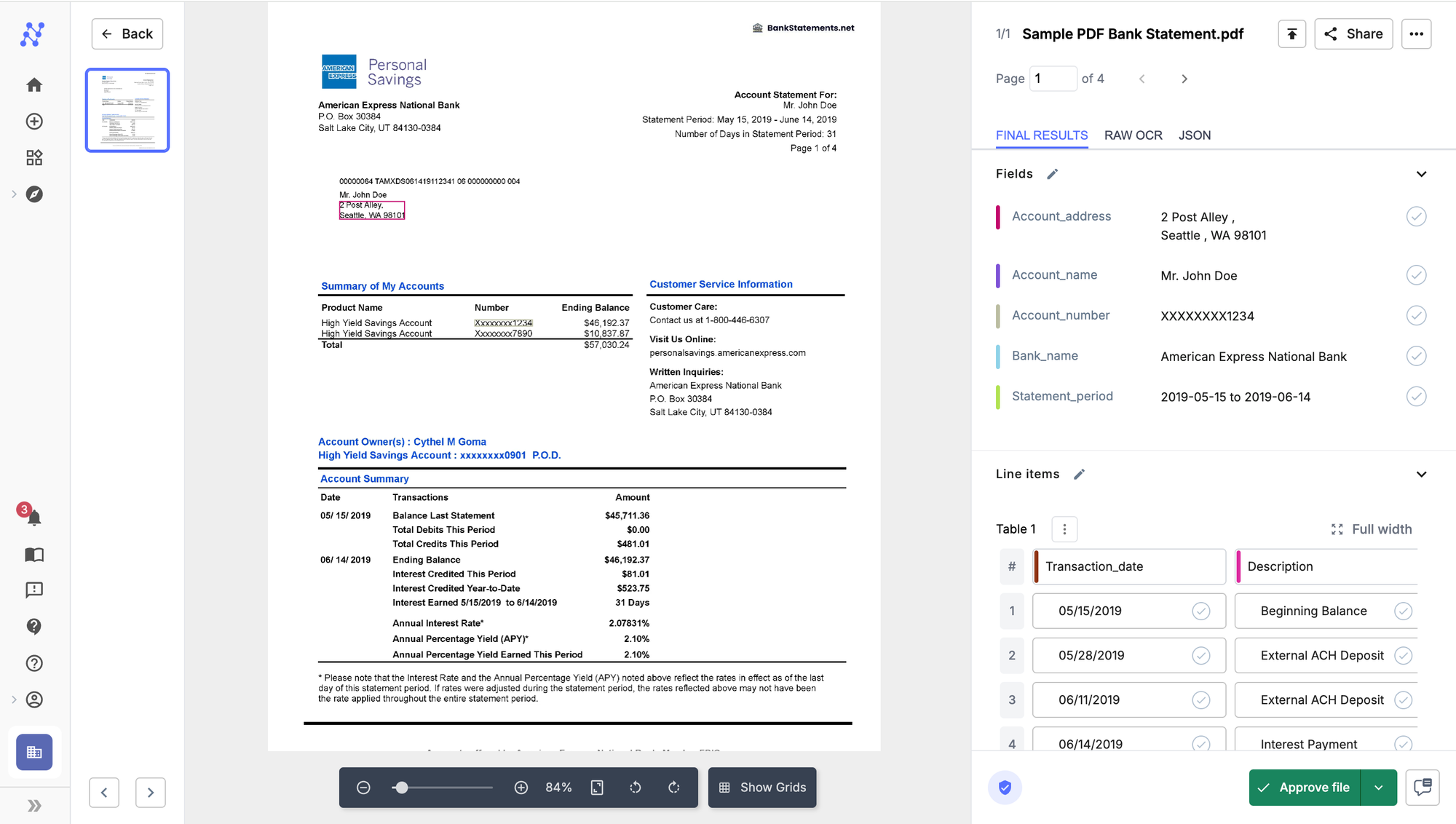

1. Nanonets

That includes on the prime of the record and the most effective financial institution assertion reconciliation software program in 2024, is Nanonets. Powered by generative-AI, Nanonets presents a pre-trained financial institution assertion extractor in addition to a zero-training extractor that may be arrange for financial institution statements in seconds.

It might probably deal with financial institution statements with sophisticated layouts (assume, multi-line objects, nested tables, and so on.) all completely different from each other, in addition to help 110+ languages.

It has a built-in “information actions” centre which presents superior formatting capabilities, like, including/eradicating fields, fuzzy-matching fields in opposition to exterior databases, computerized categorisation, and so on. It additionally has approval workflows built-in that may flag financial institution statements with lacking fields or incorrectly extracted information factors.

With its one-click integration and mapping functionality, you may arrange automated export out of your financial institution statements straight into exterior software program, be it accounting software program like Quickbooks, Sage, Xero, and so on. or ERPs, like Salesforce. Mix that with automated import and you’ve got a complete automated workflow, end-to-end.

Key Options:

- Can reconcile financial institution statements in opposition to different monetary paperwork like, Invoices, Receipts, Buy Orders, and so on.

- Automated import from e mail, cloud storages, APIs, or databases

- Automated export into exterior software program, be it accounting software program like Xero, Sage, Quickbooks, Salesforce, ERPs like Salesforce or databases like MsSQL, Amazon S3, and so on.

- “LLM Actions” part to routinely categorise transactions

- Constructed-in validation workflows

✅

1. Can automate end-to-end financial institution assertion reconciliation processes

2. Simple-to-use, no-code person interface

3. Affords excessive accuracy for traditional paperwork like financial institution statements

4. Can deal with financial institution statements from a number of languages, having sophisticated layouts

5. Can deal with massive volumes in a safe method. We’re SoC licensed, HIPAA and GDPR compliant.

6. Provide simple to know API endpoints

❗

1. If not correctly managed, the AI fashions would possibly grow to be too specialised to a specific format, affecting efficiency on barely completely different layouts.

2. The fee could also be larger in comparison with easier options, doubtlessly making it much less accessible for small companies or low-volume customers.

3. Regardless of the no-code interface, customers should still face a studying curve in optimising the system for greatest outcomes.

Pricing:

Nanonets caters to people, freelancers, consultants and companies of all sizes with their pricing plans. They provide a one-time trial the place you may course of as much as 500 pages totally free. Past that, the pricing plans are tiered.

- Pay-as-you-go plan: Charged at USD 0.3/web page for information extraction and USD 0.05/step for a workflow step.

- Professional plan: Charged at USD 999/month for extracting information from as much as 10,000 pages.

- Enterprise plan: Customized-priced based mostly on variety of pages wanted, customisation steps, integrations, and so on.

2. Freshbooks

FreshBooks is a well-liked accounting software program, but it surely additionally presents options for financial institution assertion processing and information extraction, though it is not its core focus. The platform permits customers to attach their financial institution accounts and bank cards straight, routinely importing transactions for simpler reconciliation.

FreshBooks can categorise transactions based mostly on predefined guidelines, decreasing guide information entry. Whereas it does not provide superior OCR for scanning bodily financial institution statements, it does present a user-friendly interface for reviewing and categorising imported transactions.

The software program’s means to generate monetary experiences based mostly on financial institution information might be useful for small companies and freelancers. Nonetheless, for complicated various codecs or high-volume financial institution assertion processing, FreshBooks will not be as sturdy as a couple of different modern-day IDP options.

Key options:

1. Automated financial institution transaction import

2. Rule-based transaction categorisation

3. Fundamental reconciliation instruments

4. Monetary report technology

✅

1. Person-friendly interface

2. Integrates financial institution information with different accounting options

3. Appropriate for small companies and freelancers

❗

1. Restricted OCR capabilities for bodily or scanned financial institution statements

2. Is probably not in a position deal with complicated or high-volume assertion processing nicely

3. Not specialised for financial institution assertion extraction, can deal with financial institution assertion reconciliation however not different workflows

Pricing:

FreshBooks presents three commonplace pricing plans:

- Lite plan ranging from $19/month

- Plus plan ranging from $33/month

- Premium plan ranging from $60/month

Nonetheless, these costs are for the general accounting software program, not particularly for financial institution assertion extraction options. All plans embody financial institution connections and transaction imports, however the variety of billable purchasers and extra options range by plan. It is price noting that FreshBooks often presents reductions, particularly for annual subscriptions.

3. ParseSoft

This software program focuses on making your transaction information or financial institution statements suitable to be imported into your accounting software program, format-wise. In consequence, it presents nice flexibility relating to the various codecs out there for conversion.

It presents options for dealing with a number of statements without delay. You may mix them or maintain them separate. You may rename these statements based mostly on predefined guidelines and assign classes to them. It additionally permits modifying your financial institution statements throughout conversion.

Key Options:

- Helps codecs like, PDFs, Photos, Textual content, Excel, CSV, in addition to accounting software program file codecs, like OFX, QFX, QBO, QIF/QMTF, MT940/STA.

- Affords integrations with Quickbooks, Quicken, Sage, Xero, Wave, Excel, Google Sheets amongst others.

- Affords highly effective renaming and categorizing options.

- Permits modifying financial institution statements throughout conversion.

- Has a number of date and time formatting choices.

✅

1. Helps a number of codecs for imports and exports

2. Affords offline licenses, which means it may be put in regionally on gadgets decreasing internet-dependency.

3. Affords a lifetime license the place you pay as soon as for entry to the software program, which makes it cost-efficient

❗

1. Sophisticated and out of date person interface which lowers ease of use

2. Restricted accuracy which, given the delicate nature of financial institution statements, can result in monetary penalties

3. Lifetime licenses might be costly for some customers

Pricing:

Propersoft presents tiered pricing, in month-to-month, annual and lifelong license codecs, the small print to that are as follows:

- Month-to-month License: It prices $19.99 monthly and consists of entry for limitless pages/statements. It helps all converters and apps and presents free updates.

- Yearly License: It prices $119.99 per 12 months. and consists of entry for limitless pages/statements. It helps all converters and apps and presents free updates.

- Lifetime License: It prices $199.99 as a one-time fee. It consists of entry for limitless pages/statements, for all converters, codecs, apps, and presents updates each 12 months.

4. DextPrepare

DextPrepare is a complete monetary administration device designed to simplify expense administration, particularly for accountants and small to medium-sized companies.

Considered one of its standout options is its financial institution assertion extraction functionality, which can be utilized to routinely seize and categorise information from financial institution statements with excessive accuracy.

Though this isn’t a spotlight function for them, this performance streamlines the financial institution assertion reconciliation course of and reduces guide information entry. The software program helps integration with numerous accounting platforms, enhancing workflow effectivity.

Key Options:

- Automated information seize and categorisation from financial institution statements.

- Handles receipts, invoices, and payments alongside financial institution statements.

- Seamless integration with main accounting software program like QuickBooks, Xero, and Sage.

- Affords a cellular utility to seize paperwork and handle bills on the go.

- Handles transactions in several currencies.

✅

Professionals:1. Handles complicated and various financial institution assertion formats2. Scalable for high-volume processing3. Steady studying and enchancment of extraction accuracy4. Sturdy information safety measures

❗

Cons:1. Might require preliminary setup and coaching for optimum performance2. Pricing could also be larger in comparison with primary accounting software program and might be vital for small companies and startups

Pricing:

DextPrepare is primarily focused at Accounting and bookkeeping corporations. It presents two plans that may be billed month-to-month or yearly. Annual plans may help you save as much as 13% on subscription prices. Under are the month-to-month charges:

- Dext Necessities: USD 229.99 monthly. Lets you have upto 10 purchasers, with limitless customers every. You get entry to all options, excluding premium options, like, PDF AutoSplit, or information insights.

- Dext Superior: USD 247.23 monthly. Lets you have upto 10 purchasers, with limitless customers every with entry to total feature-suite.

Customers additionally get the choice to construct a customized plan for themselves.

5. Infrrd

Infrrd, is an AI-powered Clever Doc Processing (IDP), that provides options for information extraction, together with pre-trained extractors for financial institution assertion processing. It leverages synthetic intelligence and machine studying to automate the extraction and categorisation of monetary information from numerous financial institution assertion codecs. It’s designed to deal with complicated, unstructured information, remodeling it into actionable insights.

With the pre-trained financial institution assertion extractor, their system can extract transaction particulars, account data, and different related monetary information, considerably decreasing guide information entry and processing time.

Key options:

1. Automated extraction of transaction particulars (dates, descriptions, quantities)

2. Clever categorisation of transactions

3. Assist for a number of financial institution assertion codecs and layouts

4. Integration capabilities with monetary software program and ERPs

5. Customisable extraction guidelines to fulfill particular enterprise wants

✅

1. Excessive accuracy charges in information extraction, decreasing guide errors

2. Potential to course of massive volumes of statements rapidly

3. Vital time financial savings in comparison with guide processing

4. Handles complicated and various assertion codecs

5. Customisable to particular enterprise necessities

❗

1. Might require preliminary setup and configuration time

2. Potential challenges with very non-standard or poorly scanned paperwork

3. Ongoing prices for software program licenses or API utilization

4. Might require human verification for ambiguous information factors

Pricing:

Infrrd sometimes presents customized pricing based mostly on particular consumer wants and processing volumes.

They’ve 3 commonplace tiers:

- Fundamental: Customized-priced. Affords options like superior pre-processing, automated auditing and flagging of inaccurate extractions, simple API integrations, and so on.

- Enterprise: Customized-priced. Affords all primary options and as well as, presents devoted help and performance-based pricing choices.

- Enterprise Plus: Customized-priced. Ensures 100% accuracy and different options, like, accelerated processing, customized dashboards, and so on.

6. Docuclipper

Docuclipper, designed particularly for doc information extraction, performs nicely in financial institution assertion processing. In contrast to basic accounting software program, Docuclipper focuses on automating the extraction of transactions, balances, and different related monetary data from each digital and scanned financial institution statements of various codecs. It’s dependable for high-volume and sophisticated extractions from financial institution statements. Its means to export information into well-liked accounting software program or spreadsheets simplifies the workflow for companies.

Key options:

1. Superior OCR know-how for digital and scanned financial institution statements

2. Automated extraction of transactions, balances, and different related monetary information factors from various codecs

3. Export choices to accounting software program or spreadsheets

✅

1. Optimised for financial institution assertion extraction

2. Handles complicated and high-volume paperwork

3. Integrates with accounting instruments and information codecs

Professionals:

❗

1. Specialised for doc extraction, not a full financial institution assertion reconciliation answer

2. Might require setup for some customized codecs

Pricing:

Docuclipper presents tiered pricing based mostly on the variety of pages processed, making it scalable for companies of various sizes.

- Starter: $39/month for 200 pages monthly.

- Skilled: $74/month for 500 pages monthly.

- Enterprise: $159/month for 2000 pages monthly.

- Enterprise: Customized pricing for a customized variety of pages monthly.

7. Parseur

Parseur is a flexible doc parsing device that may extract information from financial institution statements with its template-based strategy. It additionally has an AI-powered customized extractor that may be skilled to seize transaction particulars, balances, and account data from each digital and scanned financial institution statements.

It might probably routinely extract and categorize the info, which might then be exported to numerous accounting platforms or spreadsheets. Customers can ship of their financial institution statements by way of e mail or add them manually.

Parseur’s energy lies in its flexibility and ease of use for non-technical customers, making it appropriate for companies with various doc processing wants. The accuracy for financial institution statements, particularly of various codecs is restricted, as are the out there choices for importing and exporting your financial institution statements and extracted information respectively.

Key Options:

- OCR-powered information extraction for financial institution statements

- Customisable templates for various codecs

- Simple export to accounting instruments, CSV, and spreadsheets

✅

1. Simple to arrange and use, even for non-technical customers

2. Helps all kinds of financial institution assertion codecs

3. Versatile template creation for particular wants

❗

1. Template creation could require preliminary setup time

2. Have to create templates for each completely different format limiting scalability

3. Not as correct for complicated layouts, like nested tables, multi-line descriptions, and so on.

4. Restricted import and export choices

Pricing:

Parseur presents two kinds of plans relating to pricing. They provide a free plan that permits customers to course of 20 paperwork monthly. Paid plans are as follows:

- Micro: USD 39/month for as much as 100 pages.

- Mini: USD 69/month for as much as 300 pages.

- Starter: USD 99/month for as much as 1,000 pages.

- Premium: USD 199/month for as much as 3,000 pages.

- Professional: USD 299/month for as much as 10,000 pages.

For volumes larger than 10,000 pages monthly, the pricing turns into customized.

8. Parsio

Parsio presents automated information extraction capabilities for numerous doc sorts, together with financial institution statements. Whereas not completely centered on financial institution assertion processing, Parsio’s platform might be configured to extract information from financial institution statements utilizing customized parsing guidelines. Customers can arrange templates to determine and extract particular fields equivalent to transaction dates, descriptions, quantities, and balances from recurring assertion codecs.

The system utilises OCR know-how to course of each digital PDFs and scanned paperwork. As soon as extracted, the info might be exported to numerous codecs like CSV or JSON, or built-in with different methods by way of API. Parsio’s strategy to financial institution assertion extraction is versatile however could require extra guide setup in comparison with specialised banking extraction instruments.

Key options:

1. Customized parsing guidelines for information extraction

2. OCR capabilities for scanned paperwork

3. Template creation for recurring doc codecs

4. A number of export choices (CSV, JSON, and so on.)

5. API integration for automated workflows

6. Assist for numerous doc sorts past financial institution statements

✅

1. Versatile system adaptable to completely different assertion codecs

2. One-time setup for recurring assertion layouts

3. Handles each digital and scanned paperwork

4. Integrates with different enterprise methods by way of API

❗

1. Might require extra guide configuration than specialised financial institution assertion instruments

2. Accuracy is dependent upon the standard of user-created parsing guidelines

3. Not particularly optimised for monetary information extraction

4. Might lack superior options like computerized transaction categorisation

Pricing:

Parsio presents a tiered pricing mannequin:

1. Free plan: As much as 100 credit/month

2. Starter plan: $49/month for as much as 1,000 credit

3. Development plan: $149/month for as much as 5,000 credit

4. Marketing strategy: $249/month for as much as 12,000 credit

A single credit score lets you parse information from a single e mail/picture/doc. All paid plans embody options like OCR, API entry, and integrations, with larger tiers providing extra pages monthly and extra options like precedence help.

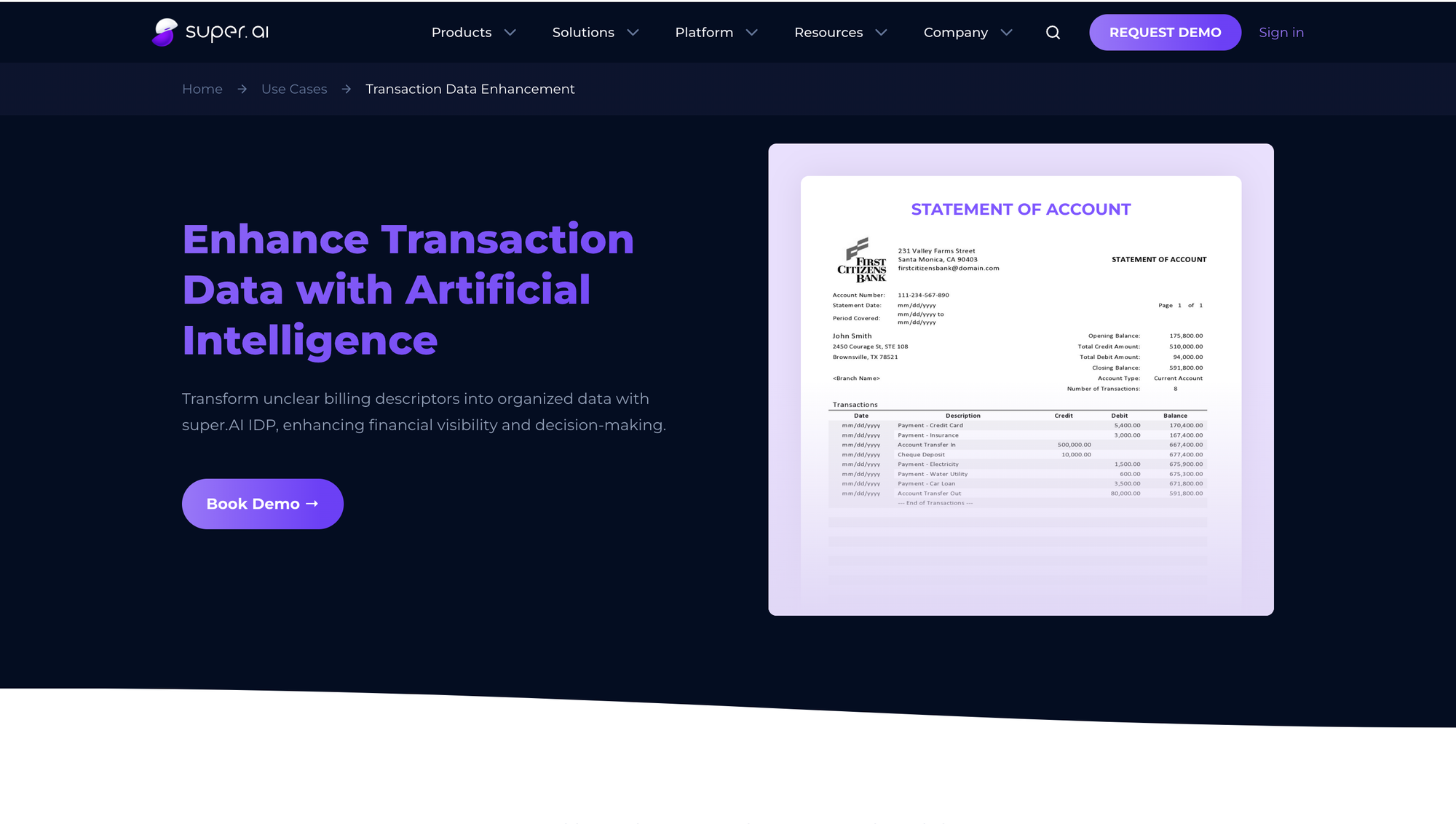

9. Tremendous.AI

Tremendous.AI presents a versatile AI-powered doc processing platform that may be tailored for financial institution assertion extraction, although it is not completely centered on this process. The platform leverages machine studying and pc imaginative and prescient applied sciences to automate information extraction from numerous doc sorts, together with financial institution statements.

Customers can prepare customized fashions to recognise and extract particular fields like transaction dates, descriptions, quantities, and balances from completely different assertion codecs. Tremendous.AI’s system can deal with each digital PDFs and scanned paperwork, utilizing OCR when essential. The extracted information might be validated in opposition to predefined guidelines and exported in numerous codecs or built-in with different methods by way of API.

Key options:

1. Customized AI mannequin coaching for particular doc layouts

2. OCR capabilities for dealing with scanned paperwork

3. Versatile information extraction guidelines

4. Human-in-the-loop possibility for high quality assurance

5. API integration for automated workflows

6. Assist for numerous doc sorts past financial institution statements

7. Information validation and cleaning instruments

✅

1. Extremely customisable to suit particular financial institution assertion codecs

2. Combines AI with human verification for improved accuracy

3. Scalable for high-volume doc processing

4. Adaptable to numerous doc sorts and layouts

❗

1. Might require vital preliminary setup and coaching for optimum efficiency

2. Not a specialised answer for financial institution assertion processing

3. Potential studying curve for non-technical customers

4. Pricing could also be larger in comparison with extra centered options

Pricing:

Tremendous.AI doesn’t publicly disclose detailed pricing data. Their pricing mannequin is often based mostly on the next elements:

1. Annual Volumes of paperwork to be processed

2. Desired information fields for extraction

- Customisation or coaching necessities

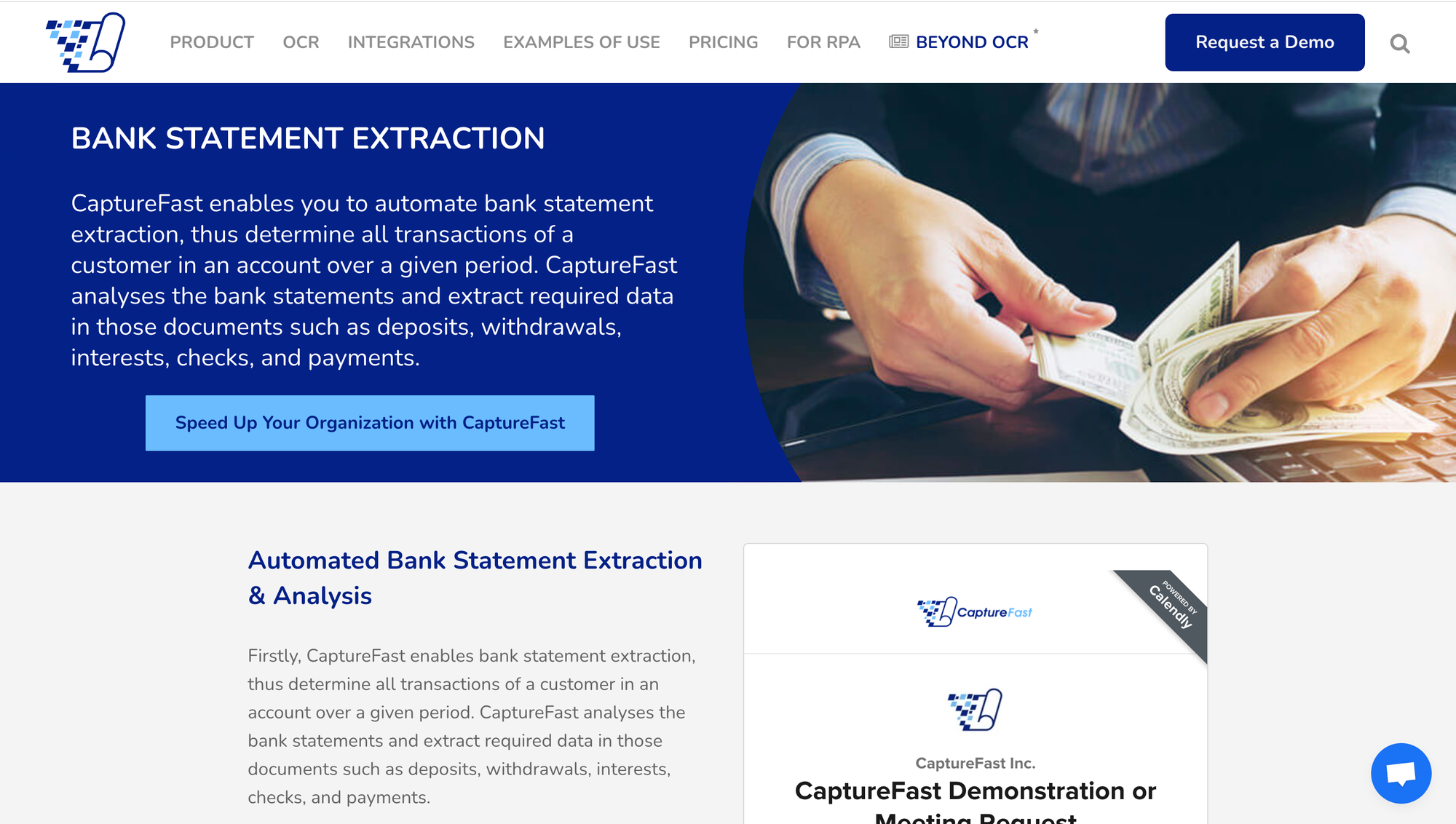

10. CaptureFast

CaptureFast presents doc processing capabilities that embody financial institution assertion extraction as a part of its broader clever doc processing platform. The system makes use of superior OCR and machine studying algorithms to automate information extraction from numerous financial institution assertion codecs.

CaptureFast can determine and extract key monetary information equivalent to transaction dates, descriptions, quantities, and account balances from each digital and scanned financial institution statements. The platform permits for the creation of customized templates to deal with completely different assertion layouts from numerous monetary establishments.

As soon as extracted, the info might be validated, categorised, and exported to numerous monetary methods or codecs for additional evaluation and reporting.

Key options:

1. Automated information extraction from a number of financial institution assertion codecs

2. Customized template creation for various assertion layouts

3. OCR capabilities for processing scanned paperwork

4. Information validation and categorization instruments

5. Integration with monetary software program and ERP methods

6. Assist for different monetary paperwork past financial institution statements

7. Cloud-based answer with safe information dealing with

✅

1. Versatile system adaptable to numerous financial institution assertion codecs

2. Excessive accuracy charges for information extraction

3. Scalable for companies of various sizes

4. Reduces guide information entry and related errors

5. Integrates nicely with present monetary workflows

❗

1. Might require preliminary setup and coaching for optimum efficiency

2. Not completely centered on financial institution assertion processing

3. Potential studying curve for complicated customizations

4. Pricing could also be larger for small companies with low quantity wants

Pricing:

CaptureFast presents a tiered pricing plan:

- Free: Customers get 100 pages/month freed from value.

- Fundamental: USD 69/month for 1,000 pages monthly.

- Skilled: USD 299/month for 10,000 pages monthly.

- Enterprise: USD 799/month for 30,000 pages monthly.

- Customized: Customized-priced based mostly on a mix of options and quantity of pages.

- Enterprise: Customized-priced for organisations that need on-premise deployment.

The record of options included in every plan varies.

How to decide on the suitable financial institution assertion OCR software program for your self?

Choosing the proper financial institution assertion extraction software program might be essential for managing funds effectively. This is a step-by-step information that will help you make an knowledgeable choice:

1. Determine Your Wants

Figuring out and documenting your wants is the essential first step when deciding on a software program. It might probably range based mostly in your function. For example, if you’re a bookkeeping agency or a contract tax marketing consultant, your wants would range from that of an enterprise seeking to automate their financial institution assertion reconciliation course of. This might, in flip be completely different from an insurance coverage startup seeking to automate their buyer onboarding/KYC course of.

Listed here are a couple of elements to think about.

- Quantity: Estimate what number of financial institution statements you must course of frequently. Excessive-volume customers may have extra sturdy options.

- Information Accuracy: Take into account how essential accuracy is to your wants. If exact information seize is crucial, search for software program with superior OCR (Optical Character Recognition) know-how.

- Integration Necessities: Decide in case you want the software program to combine along with your present accounting or monetary administration methods, equivalent to QuickBooks, Xero, or Sage.

2. Shortlist a couple of distributors and consider them

That is the place we are available. With our curated record, you will see a financial institution assertion extraction software program for each want. Discuss with the record above and shortlist a couple of distributors who you assume may help you automate your course of, particular to your wants. Listed here are a couple of elements to think about:

- Accuracy: Is the seller specialised in financial institution assertion extraction? What’s the accuracy they supply? Can they help a number of languages and codecs?

- Setup Course of: How lengthy after buy are you able to begin utilizing the software program? Are the options you might be on the lookout for ready-to-use or require customisation? Are you able to make adjustments simply? Is it safe?

- Person Expertise: Is it person pleasant? Can the non-technical crew members use the software program comfortably?

- Pricing: What’s the common market value for the feature-suite I’m on the lookout for? What’s the billing cycle (Month-to-month/Quarterly/Yearly)? Does it match my price range?

Most of those software program have a free trial interval or choices to request a customized demo. Take a look at it completely earlier than making a purchase order. You can even attain out to a couple friends to assemble suggestions or take a look at overview platforms on-line.

3. Make an Knowledgeable Determination

After you have all the data you want, it’s time to make an knowledgeable choice.

- Weigh Professionals and Cons: Examine the software program choices you’ve thought of, specializing in how nicely they meet your wants.

- Lengthy-Time period Concerns: Take into consideration how the software program will meet your wants sooner or later as your online business grows or your doc quantity will increase.

By following these steps, you may choose financial institution assertion extraction software program that not solely matches your present wants but additionally helps your long-term monetary administration targets.

![[2409.12947] Unrolled denoising networks provably study optimum Bayesian inference](https://i0.wp.com/arxiv.org/static/browse/0.3.4/images/arxiv-logo-fb.png?w=218&resize=218,150&ssl=1)