Fraud manifests in some ways. With monetary transactions and digital verifications occurring on the click on of a button, a brand new development has emerged – the rise of pretend financial institution statements.

From forging financial institution statements in job and mortgage functions to issuing pretend financial institution statements for visa processing and insurance coverage claims, these pretend paperwork critically threaten people, companies, and monetary establishments.

On this article, we’ll discover the world of pretend financial institution statements and learn to spot them. We’ll additionally focus on know-how and cutting-edge AI options that may assist companies fight financial institution assertion fraud.

Understanding financial institution statements

A financial institution assertion is an official doc issued by a financial institution that gives stability and an in depth abstract of all transactions in an account over a selected interval, usually a month.

It data your monetary exercise and is extensively accepted as proof of creditworthiness in several functions for loans, jobs, insurance coverage claims, and so forth.

Key elements of a financial institution assertion

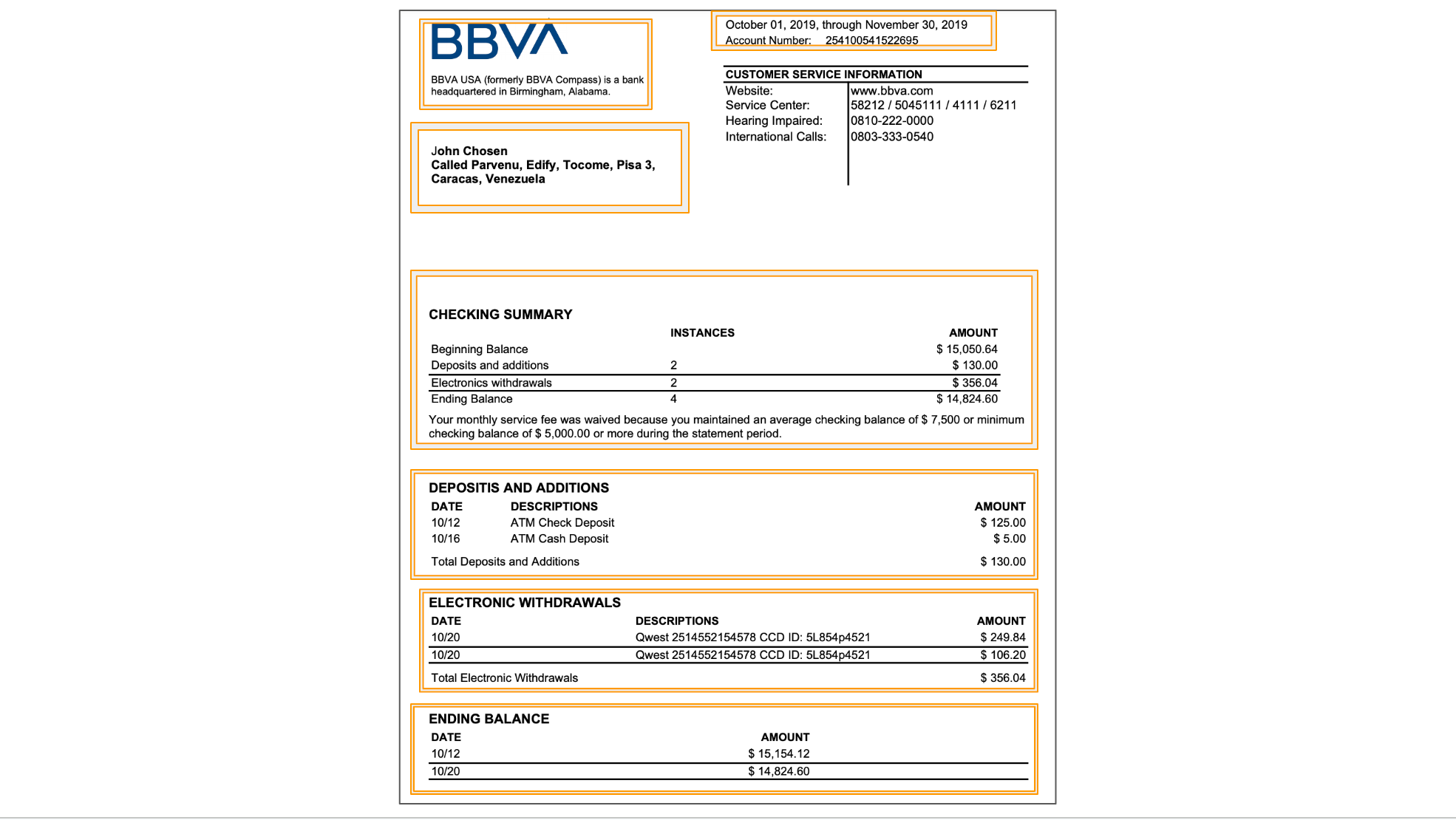

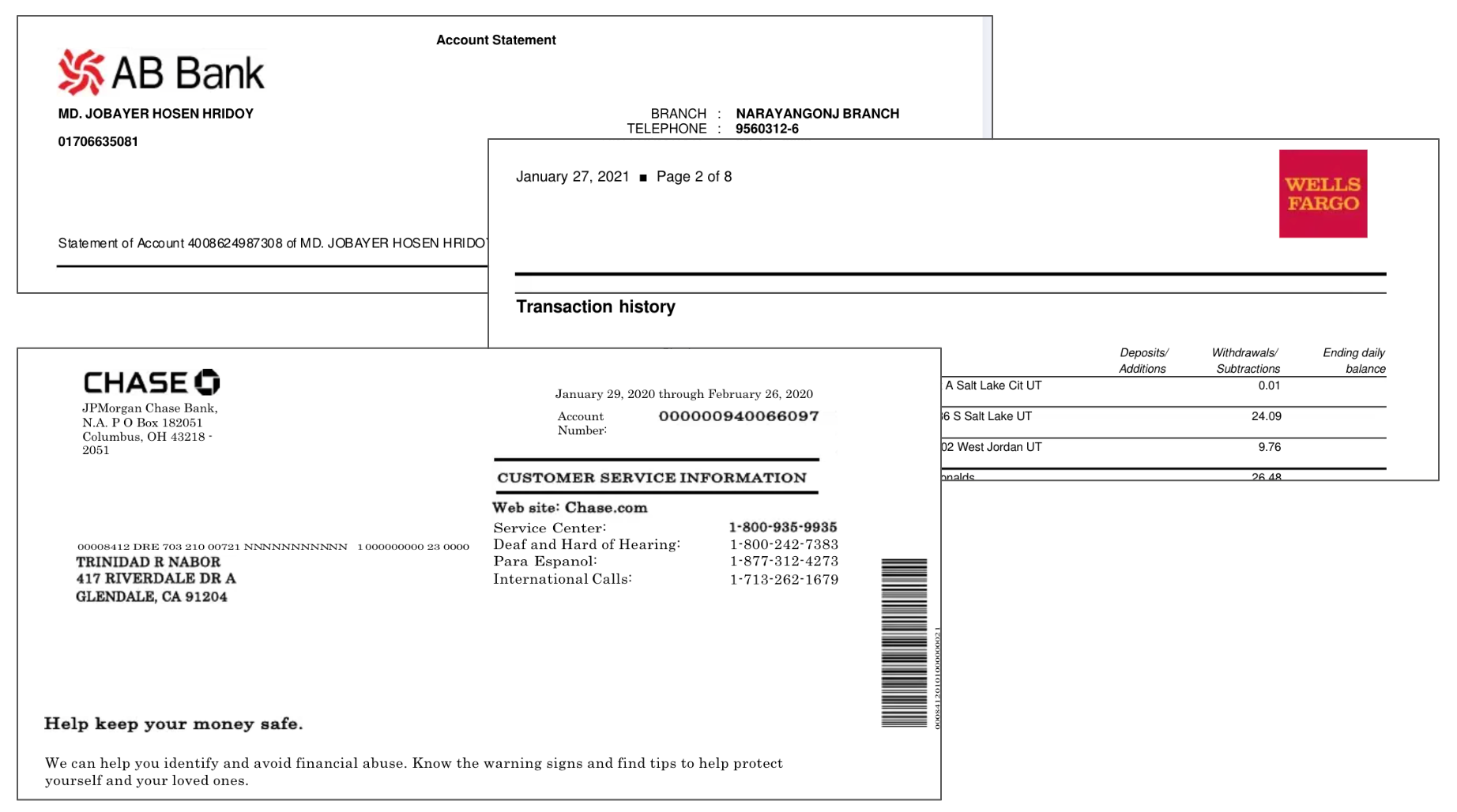

Understanding the elements of a financial institution assertion is essential for detecting potential fraud. Listed below are the necessary fields on a legit financial institution assertion:

- Financial institution data: This contains the financial institution’s official title and brand. It additionally comprises the financial institution’s contact data, the department deal with, the deal with code, and different particulars.

- Account holder particulars: This contains the account holder’s title and deal with. It additionally comprises the account quantity (which is commonly partially masked for safety, with solely the final or first three to 4 digits seen).

- Assertion interval: It mentions the beginning and finish dates of the interval coated by the assertion.

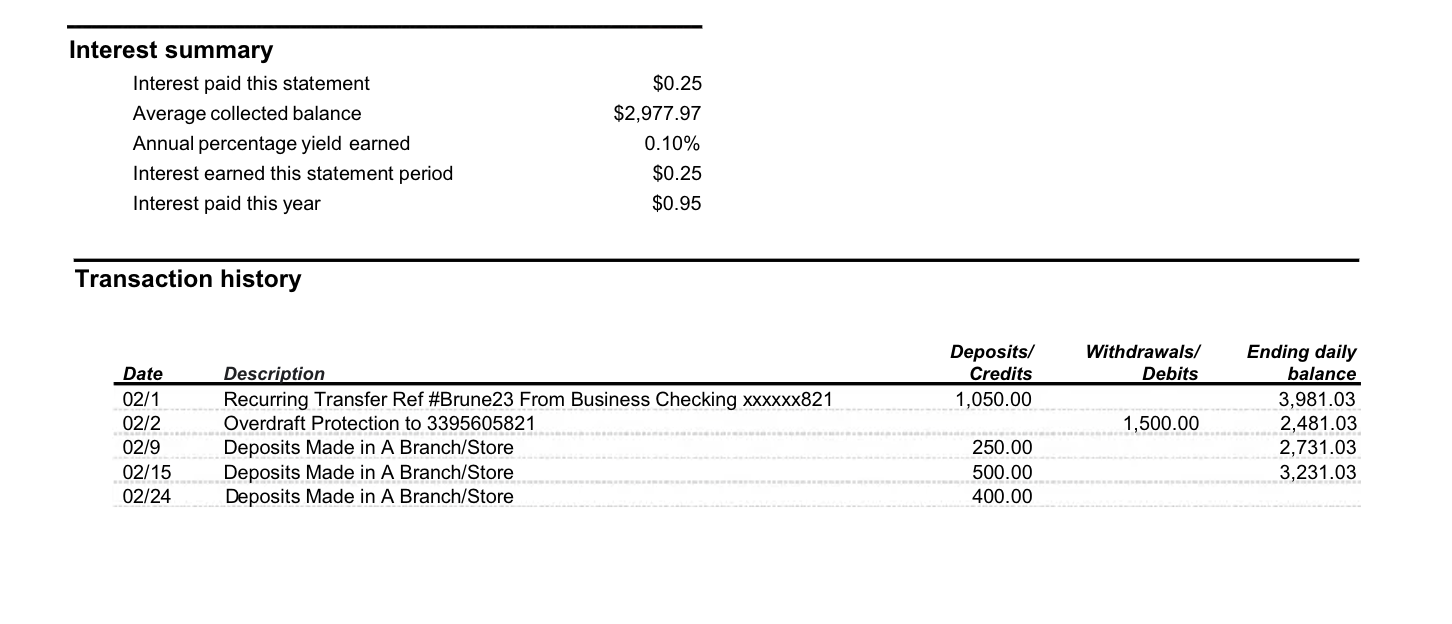

- Transaction particulars: The financial institution assertion features a desk that comprises details about all of the transactions made throughout the interval, reminiscent of:

- Date of every transaction,

- Description of the transaction (e.g., “ATM withdrawal”, “Direct Deposit”)

- Quantity debited or credited (acronym as D or C generally)

- Operating stability after every transaction

- Account abstract: The financial institution assertion additionally summarizes the next:

- Opening stability at first of the assertion interval

- Closing stability on the finish of the assertion interval

- Whole deposits and withdrawals for the interval

- Extra Info: This contains any miscellaneous data and may range for various banks:

- Any charges charged by the financial institution

- Curiosity earned (for interest-bearing accounts)

Significance of financial institution statements in monetary transactions

Financial institution statements play a vital function in varied monetary transactions and processes:

- Proof of earnings: Financial institution statements are popularly requested by lenders, landlords, interviewing firms, and authorities businesses as proof of standard earnings or monetary stability.

- Tax preparation: Financial institution statements are priceless for monitoring deductible bills and verifying earnings when getting ready tax returns.

- Accounting: For firms, financial institution statements are essential for reconciling accounts and making certain correct monetary data.

- Fraud detection: A periodic assessment of financial institution statements can assist monetary establishments detect unauthorized transactions, fraud, and id theft early.

- Visa functions: Many international locations require financial institution statements to be included to make sure guests have ample funds.

- Dispute decision: In case of discrepancies or unauthorized transactions, financial institution statements function official data for resolving disputes.

Faux financial institution statements

Faux financial institution statements are fraudulent paperwork designed to appear to be real financial institution statements.

They are often of various varieties – solid paperwork created from scratch, altered statements that manipulate precise statements by making some modifications, and, extra lately – template fraud (a type of doc fraud), the place ready-to-edit templates are used to create paperwork inside seconds.

Are pretend financial institution statements unlawful?

Utilizing pretend financial institution statements can vary from unlawful to unethical and have extreme and far-reaching authorized {and professional} repercussions.

💡

There’s no single motive why folks forge or use pretend financial institution statements.

For determined people going through monetary difficulties, falsifying monetary paperwork is a manner out of their scenario to get a job, an residence, or some monetary help.

Then again, there are skilled fraudsters, who’re organized criminals who concentrate on creating and promoting solid monetary paperwork.

Nonetheless, financial institution assertion fraud has turn out to be prevalent and more and more refined lately as a result of rising entry to superior know-how.

How financial institution assertion PDFs are manipulated

Financial institution and bank card statements are sometimes downloaded and shared immediately on the telephone in PDF format. Inevitably, all PDF recordsdata are editable – even when the unique PDF file is scanned as a picture.

With superior software program that may crack open even password-protected file statements and clever OCR instruments reminiscent of Adobe Acrobat, these financial institution statements may be simply manipulated to vary quantities, dates, and transactions.

Misuse of financial institution assertion mills

Financial institution assertion mills are on-line software program and instruments to create paperwork that replicate real financial institution statements. Whereas a few of these instruments declare to be for “novelty” or “academic” functions, they’re usually misused for fraudulent actions.

Most of those instruments are freely accessible on-line as web-based instruments, cellular apps, or downloadable software program, thus giving everybody widespread entry. Superior customers can even use programming languages to generate financial institution statements with increased customization than free instruments supply.

These financial institution assertion PDF mills will let you create, edit, signal, and share financial institution statements with others.

As detection strategies turn out to be extra refined, the dangers of trying such fraud proceed to extend. People and companies should perceive these dangers and constantly function inside authorized and moral boundaries.

Recognizing pretend financial institution statements manually

Whether or not you are a landlord, a mortgage officer, or somebody verifying monetary paperwork, understanding methods to identify forgery can shield you from fraud. Let’s dive into the important thing facets of fraudulent financial institution statements:

Visible cues and purple flags

A cautious visible inspection of financial institution statements can assist you discover purple flags and spot pretend ones early. Listed below are some early indicators of tampering:

- Inconsistent fonts: Banks use particular, constant fonts all through their paperwork which are troublesome for primary OCR software program to match. Variations in font type or measurement inside the assertion can point out tampering.

- Lack of security measures: Many banks embrace watermarks or holograms of their statements as an indication of legitimacy. Their absence may point out a pretend. Banks even use password-protected statements to permit entry solely to checking account holders. Many customers use free on-line instruments to take away encryption and edit the content material.

- Low decision, blurred characters: Reliable financial institution statements keep clear decision even when scanned. Blurry or pixelated areas would possibly point out digital manipulation.

- Misaligned parts: Search for textual content, numbers, strains, or logos that do not fairly align appropriately. Skilled financial institution statements are meticulously formatted.

- Misspellings or grammatical errors: Banks have rigorous high quality management. Poor grammar or a number of spelling errors, particularly in customary textual content point out a pretend assertion.

- Uncommon file codecs: Whereas most financial institution statements are in PDF format, it’s best to search for editable statements shared as Phrase or Excel recordsdata.

Key fields evaluation

Analyzing the content material and key fields on the financial institution assertion can reveal discrepancies:

- Reconciling financial institution assertion: Make sure the account quantity and different financial institution particulars are constant all through the doc and match another data you could have. Search for knowledge entry errors on the financial institution assertion.

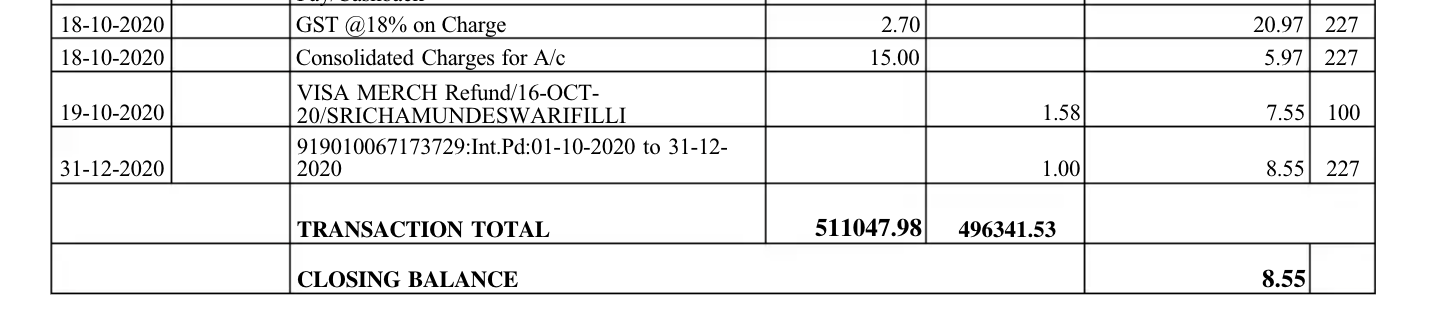

- Incorrect totals: Calculate whether or not the operating stability precisely displays the transactions listed. In fraudulent financial institution statements, the road transactions usually add up precisely. Such errors in these calculations are a transparent signal of a tampered assertion.

- Service provider particulars: Reliable statements normally present particular service provider names. Imprecise descriptions like “Cost” or “Switch” for each transaction and random transactions are a surefire telltale that one thing is fishy.

- Quantity codecs: Date, quantity, and forex codecs range between international locations. Whereas in some international locations, utilizing decimals is the norm, in others, it is a purple flag. Even a easy date inconsistency from DD/MM to MM/DD may give a pretend assertion away.

- Extra prices: Most banks cost further charges. Search for lacking or incorrect charges, an entire absence of these might be an indication of fabrication.

- Ending and beginning stability: Match ending balances from earlier statements to starting balances of subsequent statements. It may be troublesome to proceed manipulating statements with out error for an prolonged interval.

Metadata evaluation

Metadata, usually described as “knowledge about knowledge,” can assist spot pretend financial institution statements. Metadata in financial institution statements contains fields reminiscent of creation and modification date and time, creator or creator title, software program used to create or edit the doc, and variety of revisions.

- Inconsistencies between the assertion date and the doc’s creation date could be a purple flag.

- Real financial institution statements normally have minimal revisions. Even a number of modifications to the doc point out tampering.

- The financial institution’s refined software program creates legit financial institution statements. Paperwork created or edited with extraordinary workplace or picture modifying software program could also be suspicious.

Whereas these methods are good to know, with superior software program, modifying metadata is feasible. Metadata may be manipulated or stripped from paperwork, whereas canned paperwork might lose authentic metadata.

By familiarizing your self with all of the above indicators, you may be higher outfitted to identify potential pretend financial institution statements. Nonetheless, as detection strategies enhance, so do forgery methods.

Challenges in detecting financial institution assertion fraud

As detection strategies enhance, so do forgery methods. Fraudsters proceed to adapt to new safety measures, which makes detection harder.

Standardization throughout the banking {industry} is restricted, and completely different banks use various layouts and security measures. On this state of affairs, comparatively smaller newer native banks are at extra danger of financial institution assertion fraud. With extra superior modifying software program, extremely convincing fakes are doable. Some forgeries are almost indistinguishable from real statements.

Banks course of a big quantity of monetary paperwork each day, which makes thorough verification difficult. Guide verification and time constraints usually restrict the depth of particular person doc checks.

Addressing these challenges requires a multifaceted strategy by combining superior know-how and options with human experience and industry-wide collaboration.

Expertise in pretend financial institution assertion detection

Whereas pretend assertion era has turn out to be extra prevalent and complex, so has the know-how for detecting them.

Doc fraud detection software program

With laptop imaginative and prescient and AI developments, deep studying fashions can detect minute alterations and refined inconsistencies, reminiscent of structure modifications and font utilization, in digital paperwork with over 95% accuracy. They’ll analyze the seen content material and hidden metadata to disclose any indicators of doc manipulation.

Aided by human oversight, fraud detection software program makes use of AI and deep studying fashions to assist monetary establishments and corporations struggle doc fraud.

OCR and AI-enabled knowledge extraction instruments

AI-driven knowledge extraction instruments use superior OCR and NLP to acknowledge textual content, knowledge, tables, and different parts in financial institution statements and extract them precisely. This simplifies the financial institution assertion verification course of and likewise helps reconcile them sooner.

These instruments can course of giant volumes of financial institution statements in several codecs reminiscent of scanned PDFs, photographs, and so forth. With adaptive studying algorithms, the extraction accuracy will increase considerably because the device learns from new doc codecs.

These instruments considerably cut back guide processing time and errors, offering a stable basis for subsequent fraud evaluation steps.

On the lookout for OCR for financial institution assertion extraction? Attempt Nanonets AI OCR for financial institution statements. Convert PDF financial institution statements to Excel or CSV.

Information graphs and AI

Information graphs are enhancing AI-powered fraud detection in pretend financial institution statements. By representing monetary knowledge as interconnected nodes and relationships, they supply essential context that conventional databases lack.

This enables AI methods to grasp advanced patterns and inconsistencies in monetary conduct by utilizing various knowledge sources. Information graphs are extremely adaptable and are quickly updating fraud detection fashions as new fraudulent schemes emerge. Banks utilizing this know-how have reported as much as 50% enchancment in detecting refined fraud makes an attempt.

Blockchain for doc verification

In response to a 2023 report by McKinsey & Firm, some banks are experimenting with blockchain to create tamper-proof data of monetary paperwork, making it almost not possible to change statements with out detection.

Blockchain permits sooner and safer verification of worldwide financial institution statements, a course of that has been difficult and time-consuming till now.

Actual-time cross verification

Banks are more and more utilizing a collaborative strategy of shared databases of identified fraudulent actions, permitting for real-time cross-checking of submitted paperwork. To assist this, fintech firms are growing APIs that permit immediate verification of financial institution statements immediately with the issuing banks, thus considerably decreasing the window for fraud.