Monetary doc automation is not only altering the sport – it is rewriting the foundations.

From multinational banks and large accounting companies to native insurance coverage businesses and small healthcare suppliers, companies of all sizes course of tons of and hundreds of monetary paperwork each day. The sheer quantity of paperwork might be overwhelming, time-consuming, and vulnerable to errors.

Enter monetary doc automation, a game-changing resolution revolutionizing how firms deal with their paperwork, no matter measurement or {industry}.

On this article, you’ll learn to arrange environment friendly doc workflows that save time and cut back error, methods to deal with frequent challenges, and automatic instruments for various use instances throughout industries.

Monetary doc automation

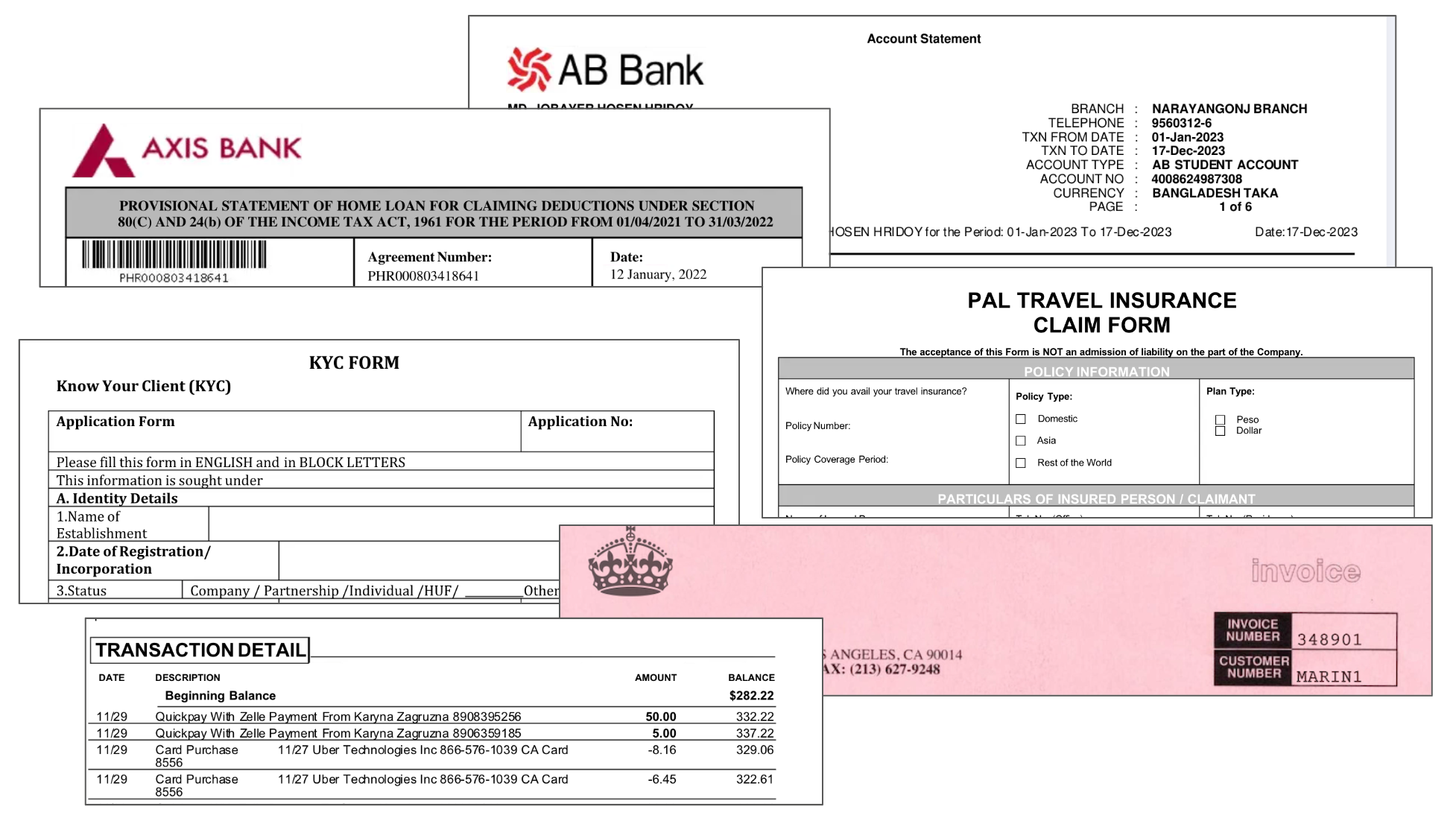

Each firm, no matter its main enterprise focus, offers with finance-related actions. These actions generate many paperwork containing vital monetary knowledge, akin to invoices, payments, payslips, kinds, KYC paperwork, financial institution statements, asset statements, loans, and tax paperwork.

These paperwork comprise delicate data, together with personally identifiable data (PII) akin to consumer and vendor names, addresses, identification numbers, and beneficiary particulars.

For giant firms with quite a few each day operations, manually managing this knowledge turns into more and more difficult, time-consuming, and error-prone.

Monetary doc automation is the answer to all these challenges

💡

Doc automation instruments, various in sophistication, can carry out completely different capabilities to streamline accounting and monetary workflows.

How does monetary doc automation work?

To grasp monetary doc automation, let’s take a look at a typical Accounts Payable (AP) course of:

- AP workforce points a buy order (PO)

- The seller delivers and sends an bill

- AP matches the bill with the PO and supply receipt

- If matched, fee is processed

This handbook course of is manageable for small firms. Nonetheless, as firms develop, the quantity of paperwork will increase exponentially, making handbook processing inefficient and error-prone.

Monetary doc automation makes use of applied sciences like superior Optical Character Recognition (OCR), Synthetic Intelligence (AI), and Machine Studying (ML) to streamline these processes.

Handbook vs Automation

Let’s evaluate handbook vs. automated AP processes:

| Step | Handbook Course of | Automated AP Course of |

|---|---|---|

| Bill receipt | PDF in Electronic mail | Any format (PDF, picture) from any supply (Slack, Cloud) |

| Knowledge entry | Handbook enter into accounting system | AI-powered computerized extraction |

| PO matching | Handbook retrieval and comparability | Computerized 2-way, 3-way & 4-way matching |

| Error checking | Handbook overview | AI-powered validation with flagging for human overview |

| Approval routing | Emails with a number of follow-ups | Computerized routing based mostly on predefined guidelines |

| Fee scheduling | Handbook entry into fee system | Computerized scheduling based mostly on phrases |

| Doc storage | Bodily submitting or fundamental digital storage | Clever digital storage with audit path |

Now, let’s perceive the outcomes and RoI in each handbook and automatic doc extraction for the above AP course of:

| Metric | Handbook course of | Automated extraction with AI |

|---|---|---|

| Processing Time | 1-3 days per bill | 5-10 minutes per bill |

| Error price | ~4% on account of handbook knowledge entry | |

| Value per bill | ~ $10-$15 | ~$2-$3 |

| Scalability | Restricted by human assets | Extremely scalable (hundreds of paperwork) |

| Vendor administration | Reactive, based mostly on points | Proactive, based mostly on knowledge insights |

| Worker focus | Knowledge entry and doc dealing with | Strategic monetary evaluation and vendor relationships |

| Money circulation visibility | Delayed, based mostly on handbook studies | Actual-time, with predictive analytics |

Easy methods to automate monetary doc workflows

Right here’s how one can arrange and automate any monetary doc workflow utilizing Nanonets:

Step 1: Create an account on Nanonets

Step 2: For common monetary paperwork akin to invoices, receipts, POs, financial institution statements, select a pre-built extractor workflow.

If you wish to arrange a brand new workflow from scratch, select Create your personal workflow and add a brand new doc.

Whilst you doc is getting processed, you’ll be able to shortly configure your import and export settings relying on the supply of your paperwork.

Step 3: As soon as the workflow is ready up and the doc is processed, overview the extracted fields within the doc and approve it as soon as prepared.

Step 4: You can even customise the workflow with completely different actions akin to:

- Including completely different formatting steps akin to forex detection, change date codecs, scan barcode and QR code, parse URL, LLM knowledge actions, and many others

- Search for new fields from exterior sources akin to Accounting software program, database, ERP instruments and

- Establishing rule-based approvals by including a number of reviewers, circumstances for flags and validation guidelines

- Arrange notifications to make sure your workforce receives well timed reminders through Slack and Electronic mail

- Customise import and export from 30+ sources

This lets you arrange personalized finance doc automation workflow for banking, monetary providers, or any finance processes.

Overcoming issues and challenges in doc automation

Whereas doc automation comes with compelling advantages, firms usually face a number of challenges and issues when implementing these techniques. Let’s handle these points and discover some sensible options:

Accuracy and reliability of monetary knowledge

Concern: Monetary knowledge requires 100% accuracy. Even small errors can result in vital monetary discrepancies or compliance points. Whereas automation can deal with normal doc, we encounter distinctive instances repeatedly which are time-consuming to deal with and in addition increase points.

Options:

- Implement multi-layer verification processes

- Design automation workflows with rule-based paths for exceptions

- Use superior deep studying fashions which are skilled on industry-specific knowledge

- Incorporate human-in-the-loop techniques for advanced or high-value transactions

💡

Design your automation workflow with rule-based clear paths for exception dealing with. This not solely improves accuracy but in addition helps in steady enchancment of the system.

Dealing with advanced and diverse doc codecs

Concern: Monetary paperwork are available in a number of codecs, languages, and constructions, making constant knowledge extraction difficult.

Options:

- Make the most of superior OCR and NLP applied sciences that work on advanced paperwork (scanned photographs, PDFs with tables, handwritten paperwork)

- Prepare fashions on a various set of doc samples

- Implement adaptive studying algorithms that enhance over time

- For template-based automated resolution, present choices for handbook template creation

Safety and compliance

Concern: Monetary knowledge is extremely delicate, elevating issues about knowledge breaches and sustaining compliance with rules.

Options:

- Select a reputed automation device that adheres to nationwide and world compliance and regulatory requirements akin to GDPR, HIPAA, SOC2, ISO 27001, FedRAMP (within the U.S.)

- Implement end-to-end encryption for knowledge in transit and at relaxation

- Use role-based entry management (RBAC) for delicate knowledge

- Recurrently conduct safety audits and penetration testing

- Limit unauthorized viewing of confidential paperwork

- Implement strict pointers to guard consumer privateness

- Contemplate on-premise deployment for extremely delicate knowledge.

Integration with current techniques

Concern: We’ve got legacy techniques (like SAP) and a posh tech stack, which makes integration difficult.

Options:

- Select an automation resolution with strong API capabilities

- Search for pre-built integrations with common monetary software program

- Interact IT groups early within the implementation course of

- Implement the change progressively, beginning with much less vital processes

- Prepare your employees with environment friendly onboarding

💡

There are lots of middleware options that firms can even briefly use for advanced integrations.

Use instances of monetary doc automation

Doc automation within the realm of finance and accounting is utilized in many sectors. Let’s discover potential use instances and advantages in several industries:

Banking and monetary providers

This sector offers extensively with monetary issues and handles an unlimited quantity of finance-related paperwork pertaining to prospects, organizations, and inside processes.

Monetary doc automation is essential to ease worker stress, enhance customer support, cut back turnaround occasions, and improve regulatory compliance.

Insurance coverage {industry}

The insurance coverage sector is one other area devoted to monetary issues. Automation instruments for dealing with insurance-related paperwork may also help with speedy data extraction and validation, elevated underwriting capability, correct threat evaluation, and quicker declare processing, leading to faster payouts for policyholders and extra environment friendly operations.

Accounting and auditing companies

Accounting companies and departments in massive companies routinely deal with paperwork with vital monetary knowledge. They’re answerable for vendor funds, sustaining transaction information, auditing, taxation, and regulatory compliance.

Automating doc processing permits these companies to shortly extract monetary knowledge from numerous sources, carry out audits with fewer handbook steps, and generate studies robotically.

Actual property and property administration

Doc automation may also help actual property firms course of massive volumes of property knowledge. This makes lease abstraction and property valuation extra environment friendly with quicker lease processing, improved accuracy in key knowledge level extraction, and higher portfolio administration. It additionally permits for faster property value determinations and improved administration of consumers, properties, and monetary information.

Healthcare

Healthcare is a sector that offers with a big number of delicate paperwork, each monetary and non-financial. Aside from affected person knowledge, there’s payroll administration for medical and non-medical employees, infrastructure-related paperwork, and different monetary transactions. Doc automation helps healthcare establishments retailer correct affected person information, course of claims extra shortly and precisely, and allow quicker affected person onboarding and transitions.

Manufacturing and provide chain

Within the manufacturing and provide chain sector, doc automation can considerably enhance accuracy in stock administration, cut back processing occasions for buy orders and invoices streamline operations, streamline high quality management processes and improve traceability within the provide chain.